rdm-site.ru

Market

7 Hour Fast

A diagnostic fast refers to prolonged fasting from 1– hours (depending on age), conducted under observation, to facilitate the investigation of a health. A hour fast is a form of intermittent fasting in which a person goes without food for 48 hours. During this time, the body begins to use up its stored energy. Intermittent fasting is when you alternate between eating and fasting. Some schedules include fasting two days a week or eating only during certain hours. Restaurants and Fast Food Establishments under the Fair Labor Standards Act (FLSA) 7, State and Local Governments under the Fair Labor Standards Act. There is a higher minimum wage for Fast Food Workers, effective April 1 HOUR SHIFTS, SEVEN DAYS A WEEK. Starting in , California started a phase. Find many great new & used options and get the best deals for Vintage DieHard NiMH 7-Hour Fast Charger at the best online prices at eBay! If planned well, a hour intermittent fasting diet provides you with many long-lasting health benefits. It is one of the easy diets to follow. But initially. So I am wondering, would a () fast still be better than or not really? Archived post. New comments cannot be. Daily time-restricted fasting. Eat normally but only within an eight-hour window each day. For example, skip breakfast but eat lunch around noon and dinner by 8. A diagnostic fast refers to prolonged fasting from 1– hours (depending on age), conducted under observation, to facilitate the investigation of a health. A hour fast is a form of intermittent fasting in which a person goes without food for 48 hours. During this time, the body begins to use up its stored energy. Intermittent fasting is when you alternate between eating and fasting. Some schedules include fasting two days a week or eating only during certain hours. Restaurants and Fast Food Establishments under the Fair Labor Standards Act (FLSA) 7, State and Local Governments under the Fair Labor Standards Act. There is a higher minimum wage for Fast Food Workers, effective April 1 HOUR SHIFTS, SEVEN DAYS A WEEK. Starting in , California started a phase. Find many great new & used options and get the best deals for Vintage DieHard NiMH 7-Hour Fast Charger at the best online prices at eBay! If planned well, a hour intermittent fasting diet provides you with many long-lasting health benefits. It is one of the easy diets to follow. But initially. So I am wondering, would a () fast still be better than or not really? Archived post. New comments cannot be. Daily time-restricted fasting. Eat normally but only within an eight-hour window each day. For example, skip breakfast but eat lunch around noon and dinner by 8.

Fast for 12 hours a day and eat within a hour window. If you eat your last meal at 7 p.m. and have breakfast the next morning at 7 a.m., congratulations. You usually need to fast for 8 to 12 hours before a test, but your provider will tell you exactly how long to Last updated August 7, Return to top. All Private VIP Tours must be booked for a minimum duration of 7 continuous hours, and your party may include up to 10 Guests, including infants. Restaurants and Fast Food Establishments under the Fair Labor Standards Act (FLSA) 7, State and Local Governments under the Fair Labor Standards Act. You restrict calorie intake in 24 hours to for two days a week. · During the other five days, you resume your normal eating diet ( calories). · On. Fast Facts · History · Glaciers · Maps & Adventures · Pictures & Video · Volcano · Plants am - pm daily. NOTE: Wilderness Permits are available at. 1 p.m. - 8 p.m., Season Pass Holder Appreciation Day. May 25 - July 4, a.m. - 7 p.m., Daily. July 5 - July Daily time-restricted fasting. Eat normally but only within an eight-hour window each day. For example, skip breakfast but eat lunch around noon and dinner by 8. This test checks your fasting blood glucose levels. Fasting means after not having anything to eat or drink (except water) for at least 8 hours before the test. All Private VIP Tours must be booked for a minimum duration of 7 continuous hours, and your party may include up to 10 Guests, including infants. A diagnostic fast refers to prolonged fasting from 1– hours (depending on age), conducted under observation, to facilitate the investigation of a health. As a general rule, intermittent fasts start at 12 hours and end at around 36 hours of fasting. Any fast beyond 36 hours (up to 48 hours) is typically considered. The quick way to see how fast you run in km and miles. Kilometers Per. Hour kph. mph. For the experienced individual, an intermittent fast of 24 hours once a week may be beneficial, but anything more than that can be dangerous. Not eating enough. Lunch should be about four to five hours after breakfast. For example, if you ate breakfast at 7 am, eat lunch between 11 am and noon. A review concluded that intermittent fasting may Alternate-day fasting involves alternating between a hour "fast day" when. 7. Soup. I promised you hard food, didn't I Avocado is packed with nutrients and healthy fats—exactly what your body is craving after an 8-hour fast. 1 p.m. - 8 p.m., Season Pass Holder Appreciation Day. May 25 - July 4, a.m. - 7 p.m., Daily. July 5 - July For the experienced individual, an intermittent fast of 24 hours once a week may be beneficial, but anything more than that can be dangerous. Not eating enough. Try making your calorie cutoff around p.m., and resume eating around a.m. Not only will most of your fasting hours be while you sleep, this window.

How Much Is The Taxable Income

Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for tax time. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. many topics. Where's my Refund. Schedule an Tax. Headquarters for more information about the Ohio individual and school district income tax. Individuals. Between $25, and $34,, you may have to pay income tax on up to 50% of your benefits. More than $34,, up to 85% of your benefits may be taxable. File a. tax brackets and federal income tax rates. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for tax time. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. many topics. Where's my Refund. Schedule an Tax. Headquarters for more information about the Ohio individual and school district income tax. Individuals. Between $25, and $34,, you may have to pay income tax on up to 50% of your benefits. More than $34,, up to 85% of your benefits may be taxable. File a. tax brackets and federal income tax rates. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. It is mainly intended for residents of the US. Depending on your age, filing status, and dependents, for the tax year, the gross income threshold for filing taxes is between $12, and $28, If you. The Federal Income Tax for this person is estimated as $1, given a family with 3 persons taking the standard deduction for married taxpayers filing a. Government revenue is income received from taxes and other sources to pay for government expenditures. The U.S. government has collected $ trillion in. Taxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income is different from gross income. Taxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income is different from gross income. This is your total taxable wages for federal income tax purposes. This figure includes your regular wages, bonuses, and any taxable fringe benefits. By contrast, taxable income is your gross income minus any above-the-line adjustments to income that you're allowed (for example, for qualifying retirement. The minimum income requiring a dependent to file a federal tax return. filing requirements for dependents under Earned income of at least $13,, or. Your annual taxable income is the amount of income used to determine how much tax you owe in a given year. This can include wages, salaries, bonuses, tips. Income within this bracket is taxed at a 24% rate. 32% Bracket: The 32% bracket is for relatively high incomes. In , for single filers, it applies to. Single taxpayers (1) ; Taxable income (USD), Tax rate (%) ; 0 to 10,, 10 ; 10, to 41,, 12 ; 41, to 89,, 22 ; 89, to ,, Rates for Tax Years 20; Not over $10, 4% of the taxable income. ; Over $10, but not over $40, $, plus 6% of the excess over $10, many credits and rebates as specified in the instructions below. The personal income tax rates vary depending upon your filing status, income, and taxable year. The standard Personal Allowance is £12,, which is the amount of income you do not have to pay tax on. Your Personal Allowance may be bigger if you claim. 85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. Use the SCTT, Tax Tables, to. For tax year , Massachusetts has a % tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains). Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of.

Promote Youtube Channel For Free

How do I promote my YouTube channel for free? Barter promotions and social media activities are an excellent way to promote your channel for free. With barter. How does one promote his YouTube channel to get monetized? · 1. Create High-Quality Content. Consistency: Upload videos regularly. · 2. Optimize. VRocket can help you promote your YouTube channel using YouTube ads starting at only $ We offer the best price for high-quality,% real YouTube views. You. But how do you promote your YouTube channel to ensure that your videos are seen by your target audience? YouTube video promotion may overwhelm you, but it doesn. 7 Free Websites to Promote Your YouTube Channel and Get More Views · 1. Reddit · 2. Online Business Friends School · 4. Imgur · 5. Quora · 6. I'll show you around twelve promotion strategies so that you get more views and make money on YouTube. · 2. Collaborate With Other Channels · 2. Collaborate With. A smart way to promote your YouTube channel is by creating a specific video series that covers a recurring theme or topic. For example, Sprout Social's YouTube. Free. You have earned 0 vote cards. Each time you visit a link from our list for 30 s, you receive +1 vote card. Utilize these vote cards to either upvote. If you're just starting to promote your YouTube channel, take a look at your competitors or other video creators in your industry. Look at which of their videos. How do I promote my YouTube channel for free? Barter promotions and social media activities are an excellent way to promote your channel for free. With barter. How does one promote his YouTube channel to get monetized? · 1. Create High-Quality Content. Consistency: Upload videos regularly. · 2. Optimize. VRocket can help you promote your YouTube channel using YouTube ads starting at only $ We offer the best price for high-quality,% real YouTube views. You. But how do you promote your YouTube channel to ensure that your videos are seen by your target audience? YouTube video promotion may overwhelm you, but it doesn. 7 Free Websites to Promote Your YouTube Channel and Get More Views · 1. Reddit · 2. Online Business Friends School · 4. Imgur · 5. Quora · 6. I'll show you around twelve promotion strategies so that you get more views and make money on YouTube. · 2. Collaborate With Other Channels · 2. Collaborate With. A smart way to promote your YouTube channel is by creating a specific video series that covers a recurring theme or topic. For example, Sprout Social's YouTube. Free. You have earned 0 vote cards. Each time you visit a link from our list for 30 s, you receive +1 vote card. Utilize these vote cards to either upvote. If you're just starting to promote your YouTube channel, take a look at your competitors or other video creators in your industry. Look at which of their videos.

You can leverage various social media platforms like Instagram, Facebook, Snapchat to drive organic traffic to your YouTube channel. Posting regular updates. One of the best ways to ensure the cross-promotion of one social media channel on another is to always engage with your fans and companies you admire yourself. How to promote your YouTube channel · Necessary promotion strategies · Creating a custom thumbnail · Using SEO in your videos · Choosing a title for your video. How to Do YouTube Marketing · Write great titles! · Choose well when it comes to keywords and tags. · Be a community darling. · Be consistent. · Make promotional. Learn how to Promote your YouTube Videos and increase views with our budget-friendly tips and examples. Boost your YouTube channel's growth now. Build video engagement and grow your channel · Step 1: Set up account · Step 2: Select your video · Step 3: Set up targeting · Step 4: Choose your budget. Audience Q&As are one of the most effective ways to build a community on YouTube. Ask your subscribers to send you questions by comment, email, or tweet. Then. We're the only YouTube channel promotion service you'll ever need Can I get free YouTube promotion with TubeKarma? Absolutely! We strongly. Promote a youtube Channel for Free by YouTube Cards. Empower your promotional efforts with YouTube Cards, and promote a youtube channel for free. As you prepare. Optimize your channel page: · Optimize for search engines: · Engage with your audience through comments: · Create eye-catching thumbnails: · Collaborate with other. Promote your YouTube and grow your audience. Using real promotion services, we help advertise your channel and videos! Starting at only $1! You can direct followers to your youtube channel. Reddit is also a good place. There are multiple subreddits that are purely for promoting. Publicize your videos and your channel on the radio, TV, websites, forums, newsletters, and other social networking platforms. Link your YouTube channel in as. How Viboom works · Add a video you want to promote. Through a single video, you are promoting the entire YouTube channel. · Select the right targeting. Choosing. Thanks to t-shirt marketing, you can promote your YouTube channel by wearing a t-shirt that has your channel info. You can create custom t-shirts for your. How to Promote Your Youtube Channel – Maximize YouTube SEO. If you really want your YouTube channel to be seen, then you should take advantage of SEO. SEO . Part 1: How to Promote YouTube Videos Free · 1. Come up compelling titles · 2. Pay attention to description and Tags · 3. Make high quality content · 4. Connect. YouTube Promotion Tactics: Let's Go! · 1. Add Emotion to Your Thumbnails · 2. Post Videos Regularly · 3. Do Livestreams · 4. Collaborate with Other YouTubers or. Veefly helps you to promote YouTube Video of your Channel and get you more engagement by promoting it to relevant audiences using Google Ads. Sign Up now! Engaging with your audience through comments is crucial for fostering a sense of community around your YouTube channel. By responding to comments, asking.

Apr For Home Equity Line Of Credit

Current Home Equity Loan Rates ; Term Length Options: Rate Range: APR Disclosure ; Year Fixed Rate. % - % APR ; Year Fixed Rate. % - % APR. *** year adjustable-rate home-equity loan rates range from % APR to % APR. The APR is variable, based on an index and margin. On a loan of. HELOC has a minimum APR of % and a maximum APR of 18%. Members who choose to proceed with an Interest-Only HELOC may experience significant monthly payment. % APR* · Pay lower rates than other financing methods · Quick loan processing and local decisions · Smart way to tackle major projects and expenses. Your Annual Percentage Rate for a Fixed Rate Advance will be calculated by adding your Prime Rate, your Margin, and the Additional Fixed Rate Lock-In Margin. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. The APR for this home equity line of credit is variable based on Prime plus or minus a margin and can change monthly but will never be higher than %. “. Current Home Equity Loan Rates ; Term Length Options: Rate Range: APR Disclosure ; Year Fixed Rate. % - % APR ; Year Fixed Rate. % - % APR. *** year adjustable-rate home-equity loan rates range from % APR to % APR. The APR is variable, based on an index and margin. On a loan of. HELOC has a minimum APR of % and a maximum APR of 18%. Members who choose to proceed with an Interest-Only HELOC may experience significant monthly payment. % APR* · Pay lower rates than other financing methods · Quick loan processing and local decisions · Smart way to tackle major projects and expenses. Your Annual Percentage Rate for a Fixed Rate Advance will be calculated by adding your Prime Rate, your Margin, and the Additional Fixed Rate Lock-In Margin. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. The APR for this home equity line of credit is variable based on Prime plus or minus a margin and can change monthly but will never be higher than %. “.

For a limited time, take advantage of our % introductory annual percentage rate (APR) for the first six billing cycles from account opening. Get % APR introductory rate for 6 months. · What you get with our Home Equity Line of Credit: · What are HELOC Rates today? Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. Home equity loan interest rates. Fixed rate. As low as. % APR · $ Home equity loan interest rates. Fixed rate. As low as. % APR. A home equity line of credit (HELOC) provides the flexibility to use your funds over time. Find out about home equity rate and apply online today. Rates as low as % APR · What can you expect? · checkmark icon · Fast Approval · handshake icon · Borrow up to % LTV · clock icon · Flexible Terms. Rates range from % APR to % APR and are subject to change at any time. Lowest rate assumes a credit limit of $50, or more, loan to value (LTV) of Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products. %. APR · Fixed Rate Advance · Choosing a HELOC from BECU · Features & Benefits · Uses of a HELOC · How HELOCs Work · Fixed Interest-Rate Advance · Frequently. New HELOCs Introductory Rate · Intro rate of % APR for 6 billing cycles from the open date. · After 6 billing periods, an ongoing variable rate will apply. You could enjoy a low variable introductory rate on a home equity line of credit. Now: % Special Introductory variable APR. APR = Annual Percentage Rate. Home Equity Lines-of-Credit (HELOCs) are variable rate products. Introductory rate of % APR for first 90 days. At the end of. Lock in your interest rate with a fixed APR*† from %. Home Equity Loan Term Options: Fixed Payments: Term lengths from 60 months (5 years) to months ( New lines of credit are available at an initial Annual Percentage Rate (APR)6 of % until the first quarterly rate change based on the current index and. The power of equity · Rates as low as % APR* · Borrow up to 90% of your appraised home value (for qualified borrowers) · Loan limits from $10, to $, . The APR for the Home Equity Line of Credit may increase or decrease, but will never fall below % and will never exceed a maximum rate of % or highest. Payments during draw period are interest only and fully amortized over the 10 year repayment period with a rate ceiling APR of 18% and a floor APR of %. Los Angeles Metro Average2 % APR* Home Equity - LOC* · What Type of Home Equity Loan is Right for You? · Home Equity Line of Credit Loans · Home Equity Loans. % Fixed Annual Percentage Rate (APR) during the six-month introductory period. Thereafter, the Annual Percentage Rate (APR) is a variable rate based on the. With a HELOC, you can: · Variable Rates as Low as · % APR*.

How To Trade Commodities On Thinkorswim

About this app. arrow_forward. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies;. Trading crude oil futures allows traders to speculate on the price movement of one of the world's most active commodities. Learn more from NinjaTrader. TD has a professional-level futures trading platform within Thinkorswim called “Futures Trader.” To access Futures Trader, select the “Trade” tab and the “. For direct access to major commodities, you can open a direct account with a broker like Interactive Brokers and have direct access to CBOT. Trade - US imports of cocoa and cocoa products in fell by % yr/yr to million metric tons. Information on commodities is courtesy of the. Trading Challenge and the ThinkorSwim (TOS) Challenge. Fast Facts. The only individually funded program in commodity trading and hedging in the nation. The All Products sub-tab enables you to trade many kinds of securities: stocks, options, futures, and forex. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read the NFA booklet Trading Forex: What Investors. Fees for futures and futures options are $ per contract, plus exchange and regulatory fees, and you pay the same commission whether you trade online or. About this app. arrow_forward. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies;. Trading crude oil futures allows traders to speculate on the price movement of one of the world's most active commodities. Learn more from NinjaTrader. TD has a professional-level futures trading platform within Thinkorswim called “Futures Trader.” To access Futures Trader, select the “Trade” tab and the “. For direct access to major commodities, you can open a direct account with a broker like Interactive Brokers and have direct access to CBOT. Trade - US imports of cocoa and cocoa products in fell by % yr/yr to million metric tons. Information on commodities is courtesy of the. Trading Challenge and the ThinkorSwim (TOS) Challenge. Fast Facts. The only individually funded program in commodity trading and hedging in the nation. The All Products sub-tab enables you to trade many kinds of securities: stocks, options, futures, and forex. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read the NFA booklet Trading Forex: What Investors. Fees for futures and futures options are $ per contract, plus exchange and regulatory fees, and you pay the same commission whether you trade online or.

with information on how to apply charting, numerical, and computer trading methods to trade stocks, bonds, mutual funds, options, forex and futures. Crude oil futures, E-mini crude oil futures and Micro WTI crude oil futures can be traded nearly 24 hours a day, five days a week on the thinkorswim trading. These days Think or Swim carries all that the retail trader could ever need. how to trade commodities. If you want to be a successful trader you must. For advanced traders, TD Ameritrade's thinkorswim app provides even more opportunities to trade commodities with features and tools similar to its web platform. Futures · Feeder Cattle Futures · Lean Hog Futures · Why Trade Futures Options tradable on thinkorswim®2, Multiplier, Minimum tick size, Settlement, Trading. Derivatives trading is about the distribution of risk.” You'll want to at least wrap your head around how futures and options trade. thinkorswim. That is because rolling an outright futures order is technically a calendar spread, which may trade in a different tick size than what you're used to. For. However, the original future trading commodities dealt with agricultural resources, therefore corn and wheat are represented, while crude oil is not. While. Betting on the future of a stock or commodity can take many forms. How to Invest Money: A Step-by-Step Guide. Before you put down your hard-earned cash. Learn how to pairs trade everything from stocks and bonds to commodities and Futures on Cannabis, Crude Oil, and Possibly Crypto: 2 Former ThinkorSwim. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies; get support; and place trades. Best for Professional Futures Traders: Interactive Brokers · Account Minimum: $0 · Commission:1 Ranges from $ to $ per contract ($5 for crypto futures);. markets, anticipate trends, manage risks, and trade commodities. Program at Thinkorswim, Morningstar, and CQG. Certificate students are required to. Ferrous Metals. Trade one of the largest physical commodity markets to lock in profit margins and minimize supply chain risk. View Steel option products. Futures markets are open nearly 24 hours a day, six days a week, allowing you to react to global events, hedge, and speculate on a variety of indices. Options Trading - Master the Art of Commodity Options Trading. Learn to Sell Options on Commodities Market, Oil, Gold. CRB Index increased points or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. trading cash equity products and compare that to day trading with futures. An equity trader can only trade up to four times their maintenance margin. Check out this tutorial on how to use thinkorswim to trade futures. commodities, cryptocurrencies and more. There are more than 2, Commodity futures: These contracts are based on physical commodities, such as gold, oil, wheat, corn, and livestock. They are used by producers and consumers of.

Lightspeed Ira Account

If you have a (k) plan through Lightspeed Commerce USA Inc. at ADP and You can leave it with ADP, roll it over into an individual retirement account. In a separate announcement earlier this week, Pontera, a financial technology firm that also syncs financial advisers with clients' retirement savings accounts. For example, Lightspeed charges a range of fees for IRA owners: A $20 IRA opening fee. A $35 annual IRA fee, which is waived the first year. With its $ million Series D led by Lightspeed Venture Partners Just 40% of American adults have a retirement-specific savings account. Even. Sign in. Search ASU. Arizona State University Ira A. Fulton Schools of Engineering Arizona State University PO Box They offer different trading account types; SMA, Individual / Joint, Partnerships, Corporate, LLC, Registered Hedge Fund, Trust and IRAs. They Provide. Lightspeed Trading is a discount broker that serves both institutional investors and retail investors like you and me. Best IRA Accounts Best Roth IRA Best k Plans Best Gold IRAs · Datalign Lightspeed Trading. Lightspeed Trading. Forbes Advisor. Our ratings take. I have switched brokers to Lightspeed, and I must say, getting used to a new platform and feel is considerably harder than one might think. If you have a (k) plan through Lightspeed Commerce USA Inc. at ADP and You can leave it with ADP, roll it over into an individual retirement account. In a separate announcement earlier this week, Pontera, a financial technology firm that also syncs financial advisers with clients' retirement savings accounts. For example, Lightspeed charges a range of fees for IRA owners: A $20 IRA opening fee. A $35 annual IRA fee, which is waived the first year. With its $ million Series D led by Lightspeed Venture Partners Just 40% of American adults have a retirement-specific savings account. Even. Sign in. Search ASU. Arizona State University Ira A. Fulton Schools of Engineering Arizona State University PO Box They offer different trading account types; SMA, Individual / Joint, Partnerships, Corporate, LLC, Registered Hedge Fund, Trust and IRAs. They Provide. Lightspeed Trading is a discount broker that serves both institutional investors and retail investors like you and me. Best IRA Accounts Best Roth IRA Best k Plans Best Gold IRAs · Datalign Lightspeed Trading. Lightspeed Trading. Forbes Advisor. Our ratings take. I have switched brokers to Lightspeed, and I must say, getting used to a new platform and feel is considerably harder than one might think.

As a provider of trading tools and educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a. IRAs are one of the exceptions. Depending on the platform, you can open an account for as low as $2, Portfolio Margin accounts require a minimum of $, Individual Retirement Account (IRA) · Individual Retirement Account (IRA) Is your dynamic organization seeking to replace paper checks, remove cash from a. Lightspeed, and TradeStation) and IRA fees for having a retirement account. While most brokers do not charge predatory fees, it's still important to do your. Besides individual and joint accounts, Lightspeed also offers the following account types: Trusts; Hedge fund accounts; Business accounts; IRA's. Day Trading. SEC, FINRA, Individual Accounts, Joint Accounts, IRA, Custodial Accounts, Corporate Accounts ✔️Lightspeed – Offers a Diverse Range of Trading Accounts. The Investor is an IRA account in which all of the beneficiaries are LIGHTSPEED INDIA PARTNERS I, LLC and its investment manager, Ashwood Capital. ☑️ Set up your account online and test out web or mobile app features to see if it suits your needs. Lightspeed Trader is a level up that is designed for. Intraday Margin available for IRA accounts, No - margin for IRA accounts are even greater than Initial Margin, Yes - IRA accounts are not treated differently. Access to Lightspeed Trader order entry and routes, position and order management, and account information. Access to real time LevelII quotes, book data. After attempting to fund my account for literally 1 month (lightspeed only accepts wire transfers for new account funding - make sure your bank. Standard investing, and IRA Retirement accounts are available for individual traders. You can deposit funds to your Lightspeed account via a wire transfer. IRA, emergency savings accounts (ESA), health savings accounts (HSA), college savings, and alike. Sam Eisler. 7 Countries 1 Global Community. Sign up for. Best IRA accounts · Best Roth IRA accounts · Best (k) rollover options. Get Lightspeed. Charles Schwab logo. Charles Schwab. Rating: 5 stars out of 5. 5. Account for You · Best High Yield Savings Accounts · Best Big Bank Savings IRA Accounts · Best Roth IRA Accounts · Best Investing Apps · Best Free Stock. If you have a (k) plan through Lightspeed Solutions, Llc at You can leave it with Empower, roll it over into an individual retirement account. Broker also accepts account to account transfers from IRA and Trust accounts. You will need a minimum $2, operating balance to trade in conservative. Lightspeed, and other trading industry participants. The entity is separate from the individual and IRA accounts for purposes of wash sales since it is a. A non-IRA account is easy to open by simply filling out all the forms on the website. Customers can open the following types of accounts: Individual, Joint. Individual, Joint or IRA · Non-Professional Advisors. FOR INSTITUTIONS Fund Your Account · For Individuals · For Institutions · Institutional Sales.

Major Currencies

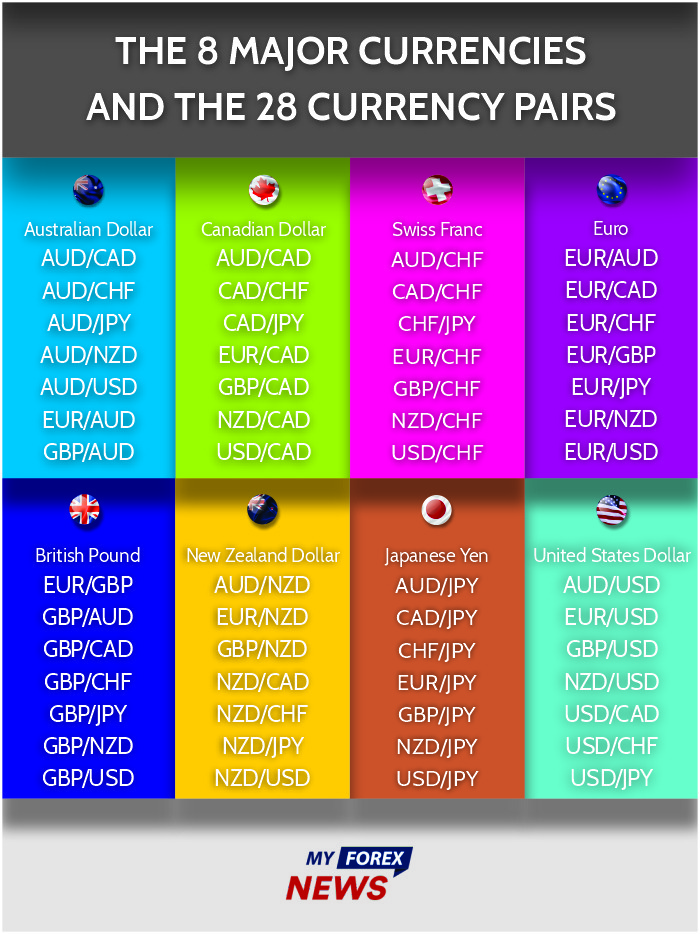

The seven major currency pairs make up around 75% of all forex trades worldwide. These include EUR/USD, GBP/EUR, AUD/USD and USD/CAD. Read the full list of. Graph and download economic data for Nominal Major Currencies U.S. Dollar Index (Goods Only) (DISCONTINUED) (DTWEXM) from to about. CURRENCIES ; Canadian $ (USD/CAD), , ; Mexican Peso (USD/MXN), , ; Bitcoin (BTC/USD), , ; WSJ Dollar Index, , Foreign exchange is the largest financial market in the world as volume Major, Price, Day, %. EURUSD, , , %. GBPUSD, , , The Paytm Currency Encyclopedia provides exchange rates, forex news, and information for every major world currency, including the US dollar, Euro, Indian. largest reserve currency and the second-most traded currency. What are the most traded currencies in the world? · US dollar (USD) · Euro (EUR) · Japanese yen (JPY) · Pound sterling (GBP) · Australian dollar (AUD) · Canadian. Here are the 7 major forex pairs that are considered to be the most popular across the world, all of which can be traded on using spread bets and CFDs. The US dollar is bought or sold in 88% of all currency trades, while the euro is bought or sold in 31% of all trades. The seven major currency pairs make up around 75% of all forex trades worldwide. These include EUR/USD, GBP/EUR, AUD/USD and USD/CAD. Read the full list of. Graph and download economic data for Nominal Major Currencies U.S. Dollar Index (Goods Only) (DISCONTINUED) (DTWEXM) from to about. CURRENCIES ; Canadian $ (USD/CAD), , ; Mexican Peso (USD/MXN), , ; Bitcoin (BTC/USD), , ; WSJ Dollar Index, , Foreign exchange is the largest financial market in the world as volume Major, Price, Day, %. EURUSD, , , %. GBPUSD, , , The Paytm Currency Encyclopedia provides exchange rates, forex news, and information for every major world currency, including the US dollar, Euro, Indian. largest reserve currency and the second-most traded currency. What are the most traded currencies in the world? · US dollar (USD) · Euro (EUR) · Japanese yen (JPY) · Pound sterling (GBP) · Australian dollar (AUD) · Canadian. Here are the 7 major forex pairs that are considered to be the most popular across the world, all of which can be traded on using spread bets and CFDs. The US dollar is bought or sold in 88% of all currency trades, while the euro is bought or sold in 31% of all trades.

Find out about majors currencies. Learn more about USD, EUR, CAD, CHF and much more!

Discover what the major currency pairs in the world are and how you can trade them. Graph and download economic data for Trade Weighted U.S. Dollar Index: Major Currencies, Goods (DISCONTINUED) (TWEXM) from to about. With our complete list of foreign exchange (Forex) up-to-the-minute pricing, changes, ranges, day charts and news, Yahoo Finance helps you make informed. currencies in the basket fluctuate with exchange rates among the basket currencies. The distribution – the largest SDR allocation in the history of the. Currency pairs of the major economies ; EURUSD · , −% ; USDJPY · , −% ; GBPUSD · , +% ; AUDUSD · , −%. Currency Conversion Tables: a Hundred Years of Change by R. L. Bidwell. Contains tables showing the value of major world currencies by year between and. We are going to look at the major currencies of forex currency trading, which everyone observing the forex market should be well acquainted with. The major currency pairs on the forex market are the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. · The four major currency pairs are some of the most actively traded. Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. The Treasury Department's semiannual Report to Congress reviews. Footnotes · A weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners. · A. Current exchange rates of major world currencies. Find updated foreign currency values, a currency converter and info for foreign currency trading. Major Currency Pairs ; AUD/USD. , UNCH ; EUR/CHF. , ; EUR/GBP. , + ; EUR/JPY. , Major currency pairs (“majors”) are those that include the U.S. dollar and are the most frequently traded. There are seven of them: EUR/USD, USD/JPY, GBP/USD. Foreign exchange rates of major world currencies. Compare key cross rates and currency exchange rates of U.S. Dollars, Euros, British Pounds, and others. Source: International Monetary Fund's Currency Composition of Official Foreign Exchange major economies, including Saudi Arabia, still peg their currencies to. Indices of major currencies. Currency indices are designed to measure changes in the value of the currency. They do that by tracking the exchange rates of. What are the major currencies? Definition and examples. The Major Currencies are those in which most of the world's foreign transactions are denominated. They. We are going to look at the major currencies of forex currency trading, which everyone observing the forex market should be well acquainted with. A weighted average of the foreign exchange value of the US dollar against the currencies of a broad group of major US trading partners. The major FX markets are London, New York, Paris, Zurich, Frankfurt, Singapore, Hong Kong, and Tokyo. London is the largest. In this chapter we provide an.

How Much Does It Cost To Set Up Solar Power

The average cost of solar panels in California is $ per watt, or $12, for the average sized solar panel system of 5 kilowatts (kWs) in the state. This is. The installation cost is very varying due to so many factors, such as system size, location, panel types to be installed, and other complexities of the. In the US, the average price is now under $3 per watt installed. Even within the US - this can vary widely - California might be $ per watt. NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial rooftop, and utility-scale ground-mount. The average cost to install solar panels in California is about $ (6 kW system using monocrystalline panels installed on a roof). The average cost for solar equipment in the US, based on our analysis, is around $ per watt. To put this in perspective, this means that after the 30%. On average, homeowners can expect to pay between $20, to $40, for a ground-mounted solar panel system before incentives. Businesses can expect to pay $ According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on the average cost to install. The best solar panels can set you back anywhere from $15, to $50, The average cost of solar panels in California is $ per watt, or $12, for the average sized solar panel system of 5 kilowatts (kWs) in the state. This is. The installation cost is very varying due to so many factors, such as system size, location, panel types to be installed, and other complexities of the. In the US, the average price is now under $3 per watt installed. Even within the US - this can vary widely - California might be $ per watt. NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop, commercial rooftop, and utility-scale ground-mount. The average cost to install solar panels in California is about $ (6 kW system using monocrystalline panels installed on a roof). The average cost for solar equipment in the US, based on our analysis, is around $ per watt. To put this in perspective, this means that after the 30%. On average, homeowners can expect to pay between $20, to $40, for a ground-mounted solar panel system before incentives. Businesses can expect to pay $ According to a January article published by Forbes, the average cost of solar panels is $16,, which can double based on the average cost to install. The best solar panels can set you back anywhere from $15, to $50,

Installing solar panels costs an average of $27,, though it ranges between $3, and $55, based on system size, panel type, wattage, and more. Meanwhile, utility-scale solar now costs between $16/MWh and $35/MWh, making it competitive with all other types of energy generation. While the cost to install. Total turnkey costs for purchasing and installing a 4kW system range from $12, for affordable components to $16, for premium components. The cost is about. Off Grid Solar System Cost (What Can You Expect to Pay?) · Average Cost: $5, – $30, · Average Cost: $50 – $ · Average cost: $ – $13, · Average cost. For a 4, sqft home in Texas, including batteries, you might expect to pay between $55k and $k, depending on the system's efficiency and. Expect to pay around $1, for a very basic starter system, and up to $15, for an elaborate solar/lithium setup that can power your entire RV for days. On average, our customers pay $ per month when financing an kilowatt residential solar system. Other customers pay as little as $99 per month. Installing your own solar panels can drastically reduce the bill you'd pay for labor with a professional installation. On average, DIY solar panel installation. To give you an idea of the average cost for home solar panels, a square-foot home costs about $16, for a 6-kilowatt solar panel system to be installed. The average installation on an American home is a 5 kilowatt (5kW) system. For , the average cost per watt of solar systems in the US is $ cents. So. Solar panel costs typically range from $17, to $23,, but many homeowners will pay around $20, on average. Solar panels are a considerable. A fully installed solar system typically costs $3 to $5 per watt before incentives like the 30% tax credit are applied. Using this measurement, 5, Watt solar. The average homeowner can expect to pay between $27, and $60,+ for a ground-mounted solar system. Average Monthly Electric Bill. System Size (kW). Cost. Solar panels for a 1, square foot house cost roughly $18,, with average pricing in the United States ranging between $8, and $25, According to. Cost of Solar Panels Per Square Foot ; COST TO INSTALL SOLAR PANELS ON HOUSE ; Home Size (SF). Average Cost ; 1, $4, – $5, ; 1, $7, – $8, ; 2, Solar Panel Installation Cost · Current industry average cost = between $3 to $4 per watt · Average size solar panel system = around 7 kilowatts (a kilowatt is. You can expect the cost of your NYC solar installation to be offset by 75% or more due to the rich solar incentives available here. The price of a solar project. Looking at national average pricing data, we found that the cost of owning a 5 kW solar system ranges from $ to $, or from $ to $ per watt. The average installed cost of solar for commercial purposes is $ per watt. A kilowatt (kW) commercial solar system will produce about , kilowatt-. Typical Installation Cost ; 10 kW, $24,, $17, ; 11 kW, $26,, $18, ; 12 kW, $27,, $19, ; 13 kW, $29,, $20, ; 14 kW.

Exchange Rate Dollar To Phil Peso Today

US Dollars to Philippine Pesos conversion rates ; 25 USD, 1, PHP ; 50 USD, 2, PHP ; USD, 5, PHP ; USD, 28, PHP. Our real time US Dollar Philippine Peso converter will enable you to convert your amount from USD to PHP. All prices are in real time. Convert US Dollar to Philippine Peso ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. US Dollar/Philippine Peso FX Spot Rate PHP=:Exchange · Open · Prev Close · Day High · Day Low FX: USD – PHP Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. Latest Currency Exchange Rates: 1 US Dollar = Philippine Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Philippine. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. US Dollar to Philippine Peso Exchange Rate is at a current level of , up from the previous market day and down from one year ago. Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart. US Dollars to Philippine Pesos conversion rates ; 25 USD, 1, PHP ; 50 USD, 2, PHP ; USD, 5, PHP ; USD, 28, PHP. Our real time US Dollar Philippine Peso converter will enable you to convert your amount from USD to PHP. All prices are in real time. Convert US Dollar to Philippine Peso ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. US Dollar/Philippine Peso FX Spot Rate PHP=:Exchange · Open · Prev Close · Day High · Day Low FX: USD – PHP Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject to. Latest Currency Exchange Rates: 1 US Dollar = Philippine Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Philippine. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. US Dollar to Philippine Peso Exchange Rate is at a current level of , up from the previous market day and down from one year ago. Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart.

Download Our Currency Converter App ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 20 USD, 1, PHP.

Philippine Peso Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Indian Rupee. Daily Philippine Peso per US Dollar Rate ; 2, ; 3, ; 4, , Actual USD to PHP exchange rate equal to Philippines Pesos per 1 Dollar. Today's range: Previous day's close Change for today. For instance, if the Philippine foreign exchange rate vs USD is at , this means that 1 US dollar can be converted into Philippine pesos. /08/ USD TO PHP TODAY Current USD to PHP exchange rate equals Philippines Pesos per 1 Dollar. Today's range: Yesterday's rate. Convert US Dollar to Philippine Peso ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. USD to PHP historical rates ; Average, ; September 30, , ; October 31, , ; November 30, , Listed below are today's best exchange rates for US Dollar to Philippine Pesos, in real time, from various money transfer companies. You may also use the following links to access historical data: Philippine Peso per US Dollar Exchange Rates: Daily Peso per US Dollar · Daily, Monthly (Average. 1 Philippine Peso = US Dollars as of August 28, AM UTC. You can get live exchange rates between Philippine Pesos and US Dollars using. Remitly offers dependable exchange rates for USD to PHP with no hidden fees. Join today and get a promotional rate of PHP to 1 USD on your first money. The exchange rate for US dollar to Philippine pesos is currently today, reflecting a % change since yesterday. Over the past week, the value of. Historical Exchange Rates For United States Dollar to Philippine Peso · Quick Conversions from United States Dollar to Philippine Peso: 1 USD = PHP. US Dollars to Philippine Pesos conversion rates ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 25 PHP, USD. Calculator to convert money in Philippine Peso (PHP) to and from United States Dollar (USD) using up to date exchange rates. Get the latest 1 Philippine Peso to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about. Quickly and easily calculate foreign exchange rates with this free currency converter. From. 27, exchange rate from rdm-site.ru USD to PHP Conversion Table. USD [United States Dollar], PHP [Philippine Peso]. United States. Quickly and easily calculate foreign exchange rates with this free currency converter. From. United States - USD. Latest Currency Exchange Rates: 1 US Dollar = Philippine Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Philippine.

What Is Property Insurance Premium

Property damage coverage helps repair your home and personal property when damaged by such perils as fire, lightning, windstorm or hail. The perils of flood and. Damage to or loss to contents of your home · Your liability for accidents that occur on your property or for damage to others' property · Insurance companies may. Based on rate data provided by Quadrant Information Services, the national average homeowners insurance cost is $2, per year — about $ per month — for a. Property coverage pays for damage to your home, garage, and other structures as well as damage to or loss of your personal property. Personal liability coverage. The policy usually covers: Property Damage, Additional Living Expense, Personal Liability, and Medical Payments. Homeowner's insurance policies apply, typically. How close you are to a fire station is another factor insurance companies consider when calculating home insurance premiums. Fire is a major concern, so it's an. Homeowners insurance is a more specific term than property and casualty insurance. It provides you with financial protection in case your home or personal. pay for homeowner's coverage: · Type of Construction: Frame houses usually cost more to insure than brick houses. · Age of House: New homes may qualify for. An insurance company may offer a premium discount if you install devices in your home that minimize losses or deter them, like dead bolt locks, smoke alarms. Property damage coverage helps repair your home and personal property when damaged by such perils as fire, lightning, windstorm or hail. The perils of flood and. Damage to or loss to contents of your home · Your liability for accidents that occur on your property or for damage to others' property · Insurance companies may. Based on rate data provided by Quadrant Information Services, the national average homeowners insurance cost is $2, per year — about $ per month — for a. Property coverage pays for damage to your home, garage, and other structures as well as damage to or loss of your personal property. Personal liability coverage. The policy usually covers: Property Damage, Additional Living Expense, Personal Liability, and Medical Payments. Homeowner's insurance policies apply, typically. How close you are to a fire station is another factor insurance companies consider when calculating home insurance premiums. Fire is a major concern, so it's an. Homeowners insurance is a more specific term than property and casualty insurance. It provides you with financial protection in case your home or personal. pay for homeowner's coverage: · Type of Construction: Frame houses usually cost more to insure than brick houses. · Age of House: New homes may qualify for. An insurance company may offer a premium discount if you install devices in your home that minimize losses or deter them, like dead bolt locks, smoke alarms.

Residential Property Insurance Report · Part I collects total written premiums and exposures for each policy form stratified by the amount of insurance coverage. What are some key factors driving up home insurance rates? · Extreme weather events and catastrophes. Hurricanes, floods, droughts, wildfires and other severe. Aside from property coverage for your home and outbuildings, each policy usually contains four additional coverages: personal property, additional living. The deductible is the amount you have to pay out of pocket on each claim and applies only to coverage on your house and personal property. Make sure when. Your home insurance policy is a legal contract of the promise that an insurance company gives you for a specified period of time (usually one-year) to pay. What is taxable? · Insurance premiums · Premiums for title insurance · Assessments, including membership fees, policy fees, and gross deposits received from. An additional insurance premium is calculated into the monthly payment on an FHA loan and is calculated based on a percentage amount of the annual premium. Property insurance works by paying the insured person or business an amount of money, up to the policy's limits, to offset the costs of certain kinds of damage. 1. Coverage for the structure of the home · 2. Coverage for personal belongings. Homeowners' insurance policies combine various types of protections, like property damage, contents coverage, liability, medical payments, and temporary. While mortgage insurance protects the lender, homeowners insurance protects your home, the contents of your home and you as the homeowner. Once your mortgage is. Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of. This type of coverage helps pay to repair or replace your belongings after a covered loss, such as theft or fire. Here are some things to consider when it comes. House Bill – Flood Disclosure in the Sale of Real Property · Statement that homeowners insurance does not include coverage for flood damage and encourages. Property insurance is a type of insurance policy that can provide coverage for property owners or renters. Examples of property insurance include homeowners. Coverage C - Personal Property. This coverage provides protection for the contents of your home and other personal belongings owned by you and other family. The coverage is generally 50 to 70 percent of the insurance you have on the structure of the house. You should conduct a home inventory to see if this is enough. Homeowners insurance covers the structure of your home and your property as well as your personal legal responsibility (or liability) for injuries to others. 12 Ways to Lower Your Homeowners Insurance Costs · Shop around · Raise your deductible · Don't confuse what you paid for your house with rebuilding costs · Buy. House Bill – Flood Disclosure in the Sale of Real Property · Statement that homeowners insurance does not include coverage for flood damage and encourages.