rdm-site.ru

Overview

Business Loan 10 Years

The typical repayment period for SBA loans is up to 10 years, but you may receive up to 25 years for large fixed asset or real estate purchases. SBA microloans. SBA 7(a) business loan* · Loan amounts up to $5 million · Terms up to 10 years for business, acquisition, equipment or tenant improvement · Terms up to 7 years for. Our free business loan calculator will help you to calculate your monthly payments and the interest cost of your loan. You need 10% of the loan for a down payment, and several years of tax returns showing profit in an existing business. Then you need to find a. Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of. You'll also need to factor in the loan amount and the loan term in years or months. 10 APR for SBA (Small Business Administration) loans. Here is a breakdown. Receive up to a maximum of $1,, in aggregate financing; Terms of up to 10 years; Learn more. U.S. Loans from BMO Bank3. Reduce paperwork and get the. Our all-digital credit application process is quick and easy and typically takes less than 10 minutes. “I've been with Driven for four years and I now have. A Small Business Loan can help you purchase business assets or finance expansion plans. Amortization up to 30 years, based upon the useful life of the asset. The typical repayment period for SBA loans is up to 10 years, but you may receive up to 25 years for large fixed asset or real estate purchases. SBA microloans. SBA 7(a) business loan* · Loan amounts up to $5 million · Terms up to 10 years for business, acquisition, equipment or tenant improvement · Terms up to 7 years for. Our free business loan calculator will help you to calculate your monthly payments and the interest cost of your loan. You need 10% of the loan for a down payment, and several years of tax returns showing profit in an existing business. Then you need to find a. Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of. You'll also need to factor in the loan amount and the loan term in years or months. 10 APR for SBA (Small Business Administration) loans. Here is a breakdown. Receive up to a maximum of $1,, in aggregate financing; Terms of up to 10 years; Learn more. U.S. Loans from BMO Bank3. Reduce paperwork and get the. Our all-digital credit application process is quick and easy and typically takes less than 10 minutes. “I've been with Driven for four years and I now have. A Small Business Loan can help you purchase business assets or finance expansion plans. Amortization up to 30 years, based upon the useful life of the asset.

Your business' annual gross revenue is less than $10 million in the year you apply If repayment of the loan is amortized over a period longer than 15 years. Competitive fixed or floating interest rates. Interest only payments for 12 months.*; Up to 5-year term with amortization up to 10 years. Term loan for business. Prior to HCD, Karen was Communications Director for ten Business and Economic Development before moving to the Department of Finance for three years. Features. Loans from €25k - €3million; Security may be required; Loan terms from 7 to 10 years. Small Business Loan Protection available Up to five-year term with amortization for real estate up to 20 years and all other loans from 3 to 10 years. 7(a) loans are available for up to $5 million and maximum terms of 25 years for real estate or 10 years for equipment, working capital, or inventory—with both. Typically, repayment periods for equipment financing can range from 1 to 10 years, with some lenders offering longer terms for larger loans. Businesses should. loan? Use our business loan 10 years, 15 years, 20 years, 25 years. Loan amortization Choose the number of years you'll need to pay back your loan. Bank Loans · Average loan term: Three to 10 years · Maximum loan amount: $, to $1 million · Typical interest rate: 3% to 22% · Time to apply: Two weeks to. Loan amount: From $25, ; Interest rate: As low as % ; Loan terms: revolving with annual renewal ; Qualifications: Minimum 2 years in business under existing. For example, a business loan with a year term would be repaid in a series of equal monthly payments. This makes it easy to plan your cash flow and know. Long-term financing to help you expand, renovate or buy new equipment for your business. Competitive rates for terms up to 10 years. Amortization, Up to a maximum of 10 years ; Special features, Registration fees of 2% of the loan levied by the government; these may be added to the financed. The average business loan term varies based on loan type. Short-term loans have terms from 1 to 3 years and mid-term range 3 to 10 years. 10 years and the calculation depends on the income expected from your tenants. Typical term length of 10 years or more; Interest rates depending on the bank. Is based and registered in Canada. Has a good credit history. Has been operating and generating revenue for at least 2 years. A business loan gives you a lump sum of money or a revolving line of credit that you can use to cover business-related expenses. These funds can help you start. 4 Main Types of Business Loans · SBA Loan: 5%% · Business Line of Credit: 5%% · Traditional Bank Loan: 2%% · Online Lender Loan: 10%% · Working Capital. Loans may be granted for a term of up to of 10 years. The maximum guarantee supplied by the Province of Nova Scotia will be 90% of the value of all term loans. This type of operating loan supports a temporary business need and is generally expected to be repaid within a year from receiving the loan. Select Credit.

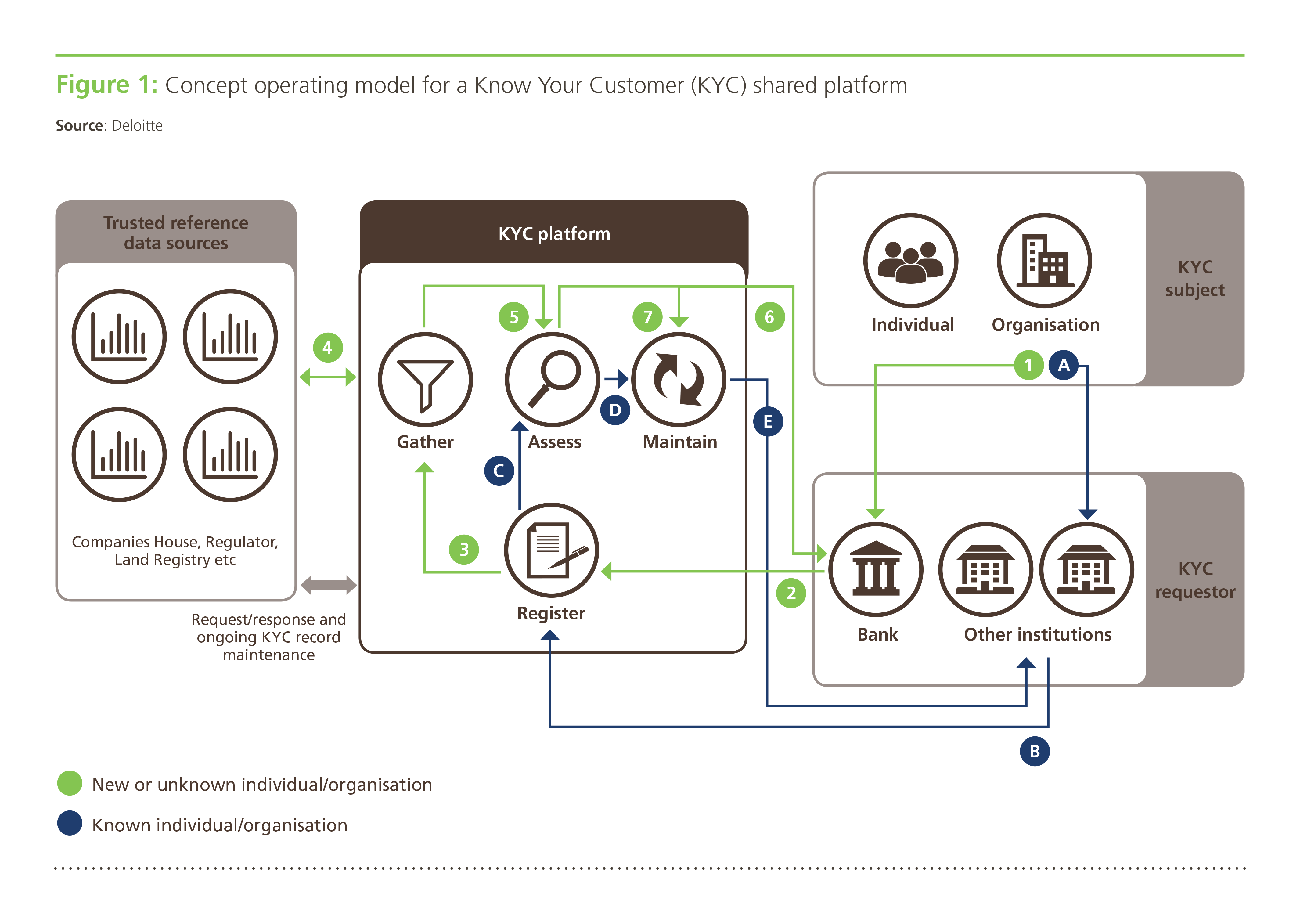

Kyc Platform

KYCP – Know Your Customer Portal – is the first Client Lifecycle Management platform on the market that allows organisations of any size or type to rapidly. One-stop-platform for due diligence. At FullCircl, we understand that customer onboarding and identity verification is more than a simple KYC check. Our W2 by. We made a list of the best KYC software providers to help you comply with KYC regulations and onboard customers while minimising risks to your business. Technical and legal solution for all KYC/AML requirements. visit website. Compare save. Sumsub is an identity verification platform designed for KYC/AML needs. platform, which is the foundation for our KYC utility service. Other EY services to help banks fight financial crime include: AML monitoring and. Accurately vet and verify your customers with an integrated platform that automates Know Your Customer (KYC) onboarding, evaluates risk, and helps your. Persona provides companies with configurable identity infrastructure for KYC, AML, KYB, fraud detection, onboarding, and more. Leverage a secure platform to manage and exchange client KYC information. Deutsche Bank is inviting customers to subscribe to this service and contribute. Know Your Customer (KYC) procedures are a critical function to assess, monitor customer risk & a legal requirement to comply with AML laws. KYCP – Know Your Customer Portal – is the first Client Lifecycle Management platform on the market that allows organisations of any size or type to rapidly. One-stop-platform for due diligence. At FullCircl, we understand that customer onboarding and identity verification is more than a simple KYC check. Our W2 by. We made a list of the best KYC software providers to help you comply with KYC regulations and onboard customers while minimising risks to your business. Technical and legal solution for all KYC/AML requirements. visit website. Compare save. Sumsub is an identity verification platform designed for KYC/AML needs. platform, which is the foundation for our KYC utility service. Other EY services to help banks fight financial crime include: AML monitoring and. Accurately vet and verify your customers with an integrated platform that automates Know Your Customer (KYC) onboarding, evaluates risk, and helps your. Persona provides companies with configurable identity infrastructure for KYC, AML, KYB, fraud detection, onboarding, and more. Leverage a secure platform to manage and exchange client KYC information. Deutsche Bank is inviting customers to subscribe to this service and contribute. Know Your Customer (KYC) procedures are a critical function to assess, monitor customer risk & a legal requirement to comply with AML laws.

Streamlined KYC Checks. Our online platform helps with customer identity verification without the need for in-person visits. With real-time access and full. Fenergo KYC is an API-first, SaaS solution that enables financial institutions to efficiently manage global KYC due diligence requirements throughout the entire. Our powerful suite of KYC and AML products can be configured for you. Digitally transform any anti-financial crime, risk management, and compliance process. platform that unites global intelligence to beat financial crime. Customer KYC Solutions. Mitigate financial crime risks with our KYC screening. A KYC (Know Your Customer) software is a tool used by businesses to verify the identity of their clients, assess risks related to money laundering and fraud. Technology platform & product development · The Swift Tech Scholarship · What's To date, almost 6, financial institutions are using the Swift KYC Registry. ACTICO KYC digitizes and automates the KYC process as part of the onboarding process. Platform. Platform Overview · Digital Decisioning Platform · Business. Platforms. Reuters Connect · World News Express · Reuters Pictures Platform · API & Feeds · rdm-site.ru Platform. Media Solutions. User Generated Content. A Know Your Customer (KYC) platform is a technology solution that enables businesses to comply with regulatory requirements by verifying and authenticating the. What are KYC platforms in crypto? KYC platforms in the crypto sphere refer to systems designed to “Know Your Customer,” ensuring the verification of users'. The registry is a secure global platform providing predefined data fields and document types to standardise and streamline the data collection process. KYC-Chain's Multi-Scope feature is a powerful tool that allows managers to create multiple client 'scopes' within a single onboarding platform. This is ideal. Quickly integrate with plug-and-play personalized solutions. Trulioo Identity Platform. Workflow-Studio. Build Trust. Securely identify business and private customers with our KYC platform → Increase your conversion rates with digital authentication processes. Automate Know Your Customer (KYC) investigations, improve accuracy, and minimize regulatory risk with a prebuilt KYC solution The Appian AI Process Platform. Barron's · MarketWatch · Financial News. Business Offerings. Risk & Compliance · Factiva · Dow Jones Newswires · Dow Jones Developer Platform. Compliance. SEON: Use Pre-KYC Checks to Save Money · Onfido: Leverage AI Liveness Verification · Trulioo: Enjoy Global Document Verification · KYC-Chain: Employ Blockchain. GetID verification platform enables you to automate the verification process and reduce your compliance team's workload. 60 seconds to verify a customer; 95%. Use this discussion guide. Most cryptocurrency platforms are considered KYC and financial institutions would have vetted their customers according to KYC. Swift platform evolution · Global Financial Messaging · Interfaces and KYC process and KYC checks. The KYC process. The KYC information is then compared.

401k Borrow To Buy A House

The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. You can borrow up to 50% of your account's vested balance, or $50,, whichever is less. Can you use a (k) to buy a house? Yes, it's possible to take. A (k) loan must be repaid-with interest while not subject to tax penalties or income taxes. Better alternatives exist like withdrawing from a Roth IRA. Or. You can borrow up to 50% of your account's vested balance, or $50,, whichever is less. Can you use a (k) to buy a house? Yes, it's possible to take. A (k) loan can help you buy a home or cover an emergency, but it also backfire if you're not careful. Author. By Seychelle Thomas. Seychelle Thomas. How Much of Your k Can Be Used for a Home Purchase. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up. Another potentially positive way to use a (k) loan is to fund major home improvement projects that raise the value of your property enough to offset the fact. The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. You can borrow up to 50% of your account's vested balance, or $50,, whichever is less. Can you use a (k) to buy a house? Yes, it's possible to take. A (k) loan must be repaid-with interest while not subject to tax penalties or income taxes. Better alternatives exist like withdrawing from a Roth IRA. Or. You can borrow up to 50% of your account's vested balance, or $50,, whichever is less. Can you use a (k) to buy a house? Yes, it's possible to take. A (k) loan can help you buy a home or cover an emergency, but it also backfire if you're not careful. Author. By Seychelle Thomas. Seychelle Thomas. How Much of Your k Can Be Used for a Home Purchase. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most. Option 1: Take a (k) Loan · The IRS is able to limit how much money you can borrow for a house downpayment. · Depending on your (k) plan, you could have up. Another potentially positive way to use a (k) loan is to fund major home improvement projects that raise the value of your property enough to offset the fact.

(k) loans are also not subject to income tax like an early withdrawal is. However, keep in mind that if you do not repay your loan within the given time. Generally, home buyers who want to use their (k) funds to finance a real estate transaction can borrow or withdraw up to 50% of their vested balance or a. Loans from a (k) are limited to one-half the vested value of your account or a maximum of $50,—whichever is less. However, even though you're borrowing. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better. One reason to almost always use a k loan for a home purchase: to increase your down payment to 20% and avoid PMI (private mortgage insurance). Employer-sponsored (k) plans may — but aren't required to — allow account holders to access savings through loans. Plans vary in their loan stipulations;. The loan must be repaid within five years, with repayments made in substantially level amounts at least quarterly. However, the repayment period may extend. One way to use (k) funds for a home purchase is through a process called a “k loan.” This allows you to borrow money from your own (k) account and pay. Borrow against your (k). Borrowing from your (k) is generally the more advantageous option if you want to tap your plan for a down payment. If your. Here's what to watch out for: You'll need to repay the loan in full or it can be treated as if you made a taxable withdrawal from your plan — so you'll have to. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan. Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. You may be able to borrow against your k for the purpose of a home purchase down payment. Read the guidelines of your k to see if this is. A (k) plan loan often needs to be repaid, allowing the employee to stay on track toward their retirement savings goals. While most (k) loans must be. Talk to your employer about loans and withdrawals from your k plan. · Talk to your mortgage loan officer about their requirements. · Gather and file the. Borrow against your (k). Borrowing from your (k) is generally the more advantageous option if you want to tap your plan for a down payment. If your. When you total up the tax bill and the 10% early withdrawal penalty, the cost of this withdrawal option far outweighs the benefits. If You Have A Roth IRA. The maximum loan amount permitted by the IRS is $50, or half of your k's vested account balance, whichever is less. During the loan, you pay principle and.

Solar Home Nj

SunPower is our top pick for the best solar company in New Jersey. As a pioneer in the solar business, SunPower has almost 40 years of experience. What Is the Average Cost of Solar Panels in New Jersey? A solar panel installation in New Jersey costs homeowners an average of around $17, for a 6 kW system. Learn about solar panel installations in New Jersey, including top companies, incentives, and installation cost estimates. The Solar Incentives NJ platform allows homeowners and aggregators to obtain either Transition Renewable Energy Certificate (TREC) or Successor Solar. Make sure your home or building is as energy efficient as possible before installing solar. Benefits include: improved comfort and safety, lower energy. Any major home improvement project requires a skilled contractor. Solar's no different. In fact, choosing a high-quality solar installer is crucial to getting a. Find out how to get approval to build your residential solar energy system and connect it to the PSE&G energy grid. No, solar panels are not free in New Jersey. Solar companies use the term “free solar panels” when they're talking about solar leases and PPAs, which are. Looking for the best solar companies in New Jersey? Sunrun leads the pack with Brightbox batteries, flexible financing options, and hefty tax incentives. SunPower is our top pick for the best solar company in New Jersey. As a pioneer in the solar business, SunPower has almost 40 years of experience. What Is the Average Cost of Solar Panels in New Jersey? A solar panel installation in New Jersey costs homeowners an average of around $17, for a 6 kW system. Learn about solar panel installations in New Jersey, including top companies, incentives, and installation cost estimates. The Solar Incentives NJ platform allows homeowners and aggregators to obtain either Transition Renewable Energy Certificate (TREC) or Successor Solar. Make sure your home or building is as energy efficient as possible before installing solar. Benefits include: improved comfort and safety, lower energy. Any major home improvement project requires a skilled contractor. Solar's no different. In fact, choosing a high-quality solar installer is crucial to getting a. Find out how to get approval to build your residential solar energy system and connect it to the PSE&G energy grid. No, solar panels are not free in New Jersey. Solar companies use the term “free solar panels” when they're talking about solar leases and PPAs, which are. Looking for the best solar companies in New Jersey? Sunrun leads the pack with Brightbox batteries, flexible financing options, and hefty tax incentives.

As a rule of thumb, a solar system in New Jersey will produce approximately 1, kilowatt-hours per year for each kilowatt of capacity you install. Thus, an. New Jersey is home to over solar installers, according to the Solar Energy Industries Association (SEIA). We've reviewed the providers in the area and. Searching for the best solar company in Williamstown, NJ? Locally owned and operated, we can install a solar panel system in Williamstown to protect you. Please note that Brightbox with Tesla or LG Chem solar battery storage is only available with the installation of a new home solar system. icon. Create and. Local solar energy experts with 10+ years of experience installing solar panels in NJ homes and providing commercial installations and maintance services. On average this Solar PV array produces over , kW/hours annually. This enough to power about 32 homes for a full year! DEP's Solar PV array is one of a. Discover the benefits of solar energy with Trinity, the largest privately-owned residential solar installer in USA. New Jersey solar companies offer a variety of resources for residential and commercial customers. Call now to learn more. FREE quotes. Solar ME is #1 for high-quality and cost-effective solar panel installation in New Jersey for your projects. Contact Solar Me today for a free quote! Solar energy is widely accepted in New Jersey, with more homeowners converting to solar power than in most other states. The high rate of solar adoption is. NJ Solar Power designs and installs custom solar energy systems tailored to your home, electricity consumption, and budget. We will make sure your system is. New Jersey solar companies offer a variety of resources for residential and commercial customers. Call now to learn more. FREE quotes. Notable Solar Installations in New Jersey · Toms River in Tom's River was developed by EDF Renewables and came online in · Prologis, Hartz Mountain. In , % of the state's electricity was generated by solar energy. This is enough to power slightly over half a million homes. Furthermore, solar panel. New Jersey offers a full exemption from the state's sales tax (currently 7%) for all solar energy equipment. This exemption is available to all taxpayers. All. Green Power Energy is a leading solar energy company dedicated to bringing renewable energy to residential and commercial properties throughout NJ. Qualified homeowners with home solar could be eligible for a tax credit of up to 30% against the cost of the system. Solar Renewable Energy Credits (SRECs). Discover the top guide to solar energy home improvement for homeowners and residents in the state New Jersey in Modernize's article. Green House Solar is an alternative to big box solar installers providing Sun Power lifetime guaranteed solar panels for affordable prices. Very happy with my solar. Especially after I bought a new electric car. My home and car energy is free, or at least will be in years, which.

Legal Guard Insurance

The LegalGUARD and PrivacyArmor plans are available to full-time and part-time benefits-eligible faculty and staff. Although the plans are administered. Protecting your personal information from identity thieves is more important than ever. Identity Theft Protection** will help you guard against losses related. With LegalGUARD, it's easy to choose the best attorney, because you get assistance from highly trained and qualified personal specialists who review the details. You pay the cost of coverage through after-tax paycheck deductions, and you can use the benefit as often as you like. Services for Free Wills and Living Wills. insurance, health insurance, and income tax payments. In order to have Coast Guard Legal Assistance · Navy JAG Corps. Navy JAG Corps Patterson. Legal Fee Guard. GenStar offers litigation insurance (insures against shifting of attorney's fees pursuant to Offer of Judgment). Learn how the LegalFeeGuard program works, how much it costs, etc. Contact An Agent Now. Buy Online. Buy Online. Buy a policy in 5 easy steps. Get. Rated A+ Superior by AM Best. © Berkshire Hathaway GUARD Insurance Companies. Terms of Use · Privacy & Security · Accessibility · Our Companies · Legal. LawGuard provides comprehensive protection at a price that actually makes sense. More than 70 legal issues are covered under every one of our plans. The LegalGUARD and PrivacyArmor plans are available to full-time and part-time benefits-eligible faculty and staff. Although the plans are administered. Protecting your personal information from identity thieves is more important than ever. Identity Theft Protection** will help you guard against losses related. With LegalGUARD, it's easy to choose the best attorney, because you get assistance from highly trained and qualified personal specialists who review the details. You pay the cost of coverage through after-tax paycheck deductions, and you can use the benefit as often as you like. Services for Free Wills and Living Wills. insurance, health insurance, and income tax payments. In order to have Coast Guard Legal Assistance · Navy JAG Corps. Navy JAG Corps Patterson. Legal Fee Guard. GenStar offers litigation insurance (insures against shifting of attorney's fees pursuant to Offer of Judgment). Learn how the LegalFeeGuard program works, how much it costs, etc. Contact An Agent Now. Buy Online. Buy Online. Buy a policy in 5 easy steps. Get. Rated A+ Superior by AM Best. © Berkshire Hathaway GUARD Insurance Companies. Terms of Use · Privacy & Security · Accessibility · Our Companies · Legal. LawGuard provides comprehensive protection at a price that actually makes sense. More than 70 legal issues are covered under every one of our plans.

Legal insurance, also known as prepaid legal or group legal, offers coverage that grants individuals and families access to a network of qualified attorneys. LegalGUARD is a legal benefits plan presented by Nationwide® Insurance, that provides support and protection from unexpected personal legal issues. The. You pay the cost of coverage through after-tax paycheck deductions, and you can use the benefit as often as you like. Services for Free Wills and Living Wills. Military OneSource offers comprehensive legal services and resources to support for service members and families. Protect you and your family from common, but costly legal issues. No insurance portfolio is complete without LawGuard. Protect yourself today. Feel the power of unlimited hours of legal protection · Legal coverage for $22/month or less · Why enroll in a legal plan? · Powerful protection · Powerful. Tesco Motor Legal Protection provides legal cover for up to £, of legal costs and expenses to help you and your passengers claim compensation for. LegalEASE's legal insurance plan covers you with concierge service that matches you to an attorney for your personal legal matters, and pays for that attorney's. Berkshire Hathaway GUARD Insurance Companies, rated A+ Superior by AM Best, provides commercial property and casualty insurance products including excess. > Legal Guard. Legal Guard. Website. Visit Our Website. Logo. About Us. About · Board of Directors · Executive Management · History of Insurance Broker. LawyerGuard offers broad coverage and a strong risk management program. Lawyers Professional Liability insurance. . . . Delivering Specialized. LegalEASE's legal insurance plan covers you with concierge service that matches you to an attorney for your personal legal matters, and pays for that attorney's. Our life insurance companies, Banner Life and William Penn, offer the best term policies with affordable coverage to help protect your family's future. The policy is an annual insurance contract underwritten by. Ageas Insurance Limited. Legal expenses cover is not available in isolation and can only. with Legal Insurance. Plan proudly offered to. Quotient Technology Employees. Protect your family's future with LegalGUARDsm. LegalGUARD offers valuable. Sound legal help that won't cost an arm & leg. Our personal & family prepaid legal plans provide access to legal counsel for various legal matters. Act now. Legal insurance covers the attorney fees and saves you time because it's easier to connect with an attorney. Top 10 Ways People Use Their Legal insurance*. Tesco Motor Legal Protection provides legal cover for up to £, of legal costs and expenses to help you and your passengers claim compensation for. legal representation provided by any other organization such as an insurance company LegalGUARD is the filed name of your new legal benefits plan. Group legal insurance plans are one of the fastest growing employer benefits. Employers that participate in a group legal plan can provide their employees.

0 Apr Credit Cards With Fair Credit

The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. 0% intro APR on qualifying balance transfers for the first 15 months following account opening when the balance is transferred within the first 90 days. Best credit cards for fair/average credit in September ; Capital One Platinum Credit Card · · on Capital One's secure site · $0. Regular APR. Free access to your credit score and credit report; The convenience of tap to pay. Low Rate. Rate. Variable APR as low as. %. Annual fee: $0. Features. Our. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Ink Business. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR OR AVERAGE CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Cash Rewards Visa®. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. Save more on interest fees with our zero percent APR credit cards. Explore Mastercard credit cards to find the right card for your lifestyle needs. The Chase Freedom Flex's long 0% APR period, generous sign-up bonus and ongoing rewards program could net you thousands in interest savings and cash back. 0% intro APR on qualifying balance transfers for the first 15 months following account opening when the balance is transferred within the first 90 days. Best credit cards for fair/average credit in September ; Capital One Platinum Credit Card · · on Capital One's secure site · $0. Regular APR. Free access to your credit score and credit report; The convenience of tap to pay. Low Rate. Rate. Variable APR as low as. %. Annual fee: $0. Features. Our. Chase Freedom Unlimited®. Visa Signature®. Visa Infinite®. Chase Freedom Unlimited®. INTRO PURCHASE APR. 0% Intro APR on Purchases for 15 months ; Ink Business. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR OR AVERAGE CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Cash Rewards Visa®. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. Save more on interest fees with our zero percent APR credit cards. Explore Mastercard credit cards to find the right card for your lifestyle needs.

Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. Best 0% APR credit cards. Wells Fargo Active Cash® Card: Best for earning cash rewards on purchases. Discover it® Cash Back: Best for first-year. 0% introductory APR for the first 12 billing cycles on balance transfers made in the first 60 days. After that, your APR will be % to % based on. 8 best 0% APR and low-interest credit cards of August · Browse by card categories · More details on the best zero interest credit cards · Comparing the best. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Credit cards for bad credit ; Milestone® Mastercard® · reviews · $0 liability for unauthorized use ; Credit One Bank® Platinum Visa® for Rebuilding Credit · Best Overall 0% APR Credit Card. U.S. Bank Visa Platinum Card. Learn More · Read more. Credit One Bank® Platinum Visa®. Visa Signature®. Visa Infinite®. Credit One Bank® Platinum Visa® · REGULAR APR. % Variable ; Revenued Business Card. Visa. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. Having difficulty getting approved for a credit card? The Avant Credit Card may be an option if you have a fair or average credit score. Apply online today. Why this is one of the best 0% introductory APR credit cards: The Wells Fargo Reflect card comes with a 0% intro APR for 21 months from account opening. After. We will apply payments up to your minimum payment first to the balance with the lowest APR (including 0% APR), and then to balances with higher APRs. We. **Recommended Credit. Fair-Poor-Bad. Annual Fee. See Website for Details*. Intro APR. N/A. Ongoing APR. 0% APR. Balance Transfer. N/A. Snapshot of Card Features. Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APRon purchases & balance transfers · No annual fee. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. If it's purely for 0% apr, you'd be better off going for an 18 or 21 mo card like the BofA Americard (18), Citi Double Cash (18), or US Bank. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. If you have fair credit, you can probably qualify for unsecured credit cards with some great perks, such as cash back rewards or no foreign transaction fees. Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus · Unlimited % cash back is. Apply for a CommunityAmerica credit card and pay no interest for 18 months, earn great rewards and enjoy no annual fee. Apply Today!

Listed Home Insurance

Listed building insurance safeguards you against the expenses of repairing or reconstructing your cherished historic property if it sustains damage or is. Covers medical costs incurred on the property by those not listed as residents of the household, regardless of fault. Custom. Coverage F: Personal Liability. We offer high quality listed building insurance that acknowledges the importance of your home's past, while protecting it in the present and securing its future. NFU Mutual Bespoke Home Insurance is specially designed for high value homes with contents valued over £, Bespoke can also protect more than just your. Abode, a Howden company, is the home of listed property insurance. Not only do they have experienced, specialist staff, but they also provide enhanced. No, Listed Building Insurance does not cover the contents of your home unless you take out a combined Listed Building and Contents Insurance policy. The Listed Property Owners Club has 25 Years experience offering specialist advice for Listed Property Owners & Listed Property Insurance. We'll consider all levels and ages of graded building. And we also cover older construction methods, such as wattle and daub, timber frame and lathe and. Insuring Your Listed Building. Listed building insurance protects properties in the UK that have special historical or architectural significance or interest. Listed building insurance safeguards you against the expenses of repairing or reconstructing your cherished historic property if it sustains damage or is. Covers medical costs incurred on the property by those not listed as residents of the household, regardless of fault. Custom. Coverage F: Personal Liability. We offer high quality listed building insurance that acknowledges the importance of your home's past, while protecting it in the present and securing its future. NFU Mutual Bespoke Home Insurance is specially designed for high value homes with contents valued over £, Bespoke can also protect more than just your. Abode, a Howden company, is the home of listed property insurance. Not only do they have experienced, specialist staff, but they also provide enhanced. No, Listed Building Insurance does not cover the contents of your home unless you take out a combined Listed Building and Contents Insurance policy. The Listed Property Owners Club has 25 Years experience offering specialist advice for Listed Property Owners & Listed Property Insurance. We'll consider all levels and ages of graded building. And we also cover older construction methods, such as wattle and daub, timber frame and lathe and. Insuring Your Listed Building. Listed building insurance protects properties in the UK that have special historical or architectural significance or interest.

Listed Buildings Insurance of both Grade 1 & 2 is important to protect the property not only for your benefit as the owner but also as part of our heritage. How can I find out the rebuild cost of my property? · What is buildings insurance? · Do you offer home insurance for listed buildings? · My property has suffered. Buildings and contents insurance for listed buildings and historic properties from Quoteline Direct specialist team. Get a bespoke quote or compare quotes. Compare listed building insurance quotes. Compare listed building insurance. We'll float your boat with a really cheap Quote! We have extensive experience insuring listed buildings, so no matter how specialised your needs are, we have the expertise to keep you covered. Protect your period property or listed building with Gallagher's high value home insurance. Policies cover includes age, construction & contents. Top Insure offer comprehensive Listed Buildings Insurance for period buildings that are used for personal, commercial or mixed use at competitive premiums. Listed building insurance works like regular home insurance: in exchange for your premiums, your property is protected in the event that it's damaged or. Cover for Grade I, Grade II*, Grade II, Category A, Category B and Category C listed homes. Frontier offers you protection and peace of mind. Read general guidance on insurance for listed buildings, dealing with cover for listed buildings, reinstatement, owner responsibilities and sourcing. Listed building insurance works like regular home insurance: in exchange for your premiums, your property is protected in the event that it's damaged or. What does listed property cover? · Accidental damage cover · Alternative accommodation cover · Wide range of cover · Theft cover · Home emergency · Legal. Cover to help you meet your obligations to maintain your listed property. Get a Quote Call Listed and period property insurance from Howden Specialist cover for non standard and listed properties over years old. As a specialist thatch and listed building insurance broker, it's our experience, expertise and quality products that set us apart. Best Homeowners Insurance Companies ; USAA · · $ ; Amica · · $ ; Allstate · · $ ; Auto-Owners · · $ ; State Farm · · $ We offer cover and guidance for every type of listed property across the United Kingdom, so you can rest assured that you're being looked after by specialists. Why do I need special listed buildings insurance? Most listed properties in the UK are Grade II listed (92%), the remainder are Grade II* or Grade I. Listing. Specialist listed building insurance policies are tailored to the risks and expenses of living in a listed building. They're offered by insurers who often have. Coverage gaps occur when a preexisting insurance policy is listed under the property owner's name before the property is transferred to an LLC. Then, when a.