rdm-site.ru

Prices

Deposit In Atm

How do ATM deposits work? You can deposit cash or checks at a variety of ATMs across our local service area and at SHAZAM® or MoneyPass ATMs around the country. While financial institutions typically don't restrict how much cash you can deposit at an ATM, you will generally face a limit on how many bills you can insert. How do ATM Deposits work? When making a deposit, simply insert cash or checks and the ATM does the rest. The ATM scans your checks, counts your bills. Here are some steps that work with most deposit-enabled ATMs according to the personal finance advisers at The Balance and NerdWallet. Access our Deposit-Ready ATMs any time day or night. Deposit a stack of up to 50 cash bills or up to 15 checks at one time, no envelope, no waiting. The majority of Old National ATMs are enabled to accept cash deposits, check deposits or both. We continue to expand the number of ATMs that accept deposits. Make Deposits at Sandy Spring Bank ATMs by simply inserting your checks and cash; no more envelopes to complete. Our policy is to make funds from your cash and check deposits available to you on the first business day after the day we receive your deposit. Funds from. Our innovative ATMs let you make deposits without envelopes or deposit slips, with extended cut-off times and green benefits. How do ATM deposits work? You can deposit cash or checks at a variety of ATMs across our local service area and at SHAZAM® or MoneyPass ATMs around the country. While financial institutions typically don't restrict how much cash you can deposit at an ATM, you will generally face a limit on how many bills you can insert. How do ATM Deposits work? When making a deposit, simply insert cash or checks and the ATM does the rest. The ATM scans your checks, counts your bills. Here are some steps that work with most deposit-enabled ATMs according to the personal finance advisers at The Balance and NerdWallet. Access our Deposit-Ready ATMs any time day or night. Deposit a stack of up to 50 cash bills or up to 15 checks at one time, no envelope, no waiting. The majority of Old National ATMs are enabled to accept cash deposits, check deposits or both. We continue to expand the number of ATMs that accept deposits. Make Deposits at Sandy Spring Bank ATMs by simply inserting your checks and cash; no more envelopes to complete. Our policy is to make funds from your cash and check deposits available to you on the first business day after the day we receive your deposit. Funds from. Our innovative ATMs let you make deposits without envelopes or deposit slips, with extended cut-off times and green benefits.

Learn how to deposit checks through our ATMs. Video Transcript: You can also deposit checks using our ATM machines. First, insert your debit card into the. DepositSmart ATMs® · Deposit up to 20 checks or 50 bills at a time into your Regions account · Load funds from cash to your Regions Now Card for immediate. Can I make a cash deposit at an ATM? Absolutely! You can make cash deposits at any of our ATM's located at your nearest branch using your Visa debit card with. Depositing checks through an ATM is generally safe. Mistakes do happen, but they're rare. The good news is that as the technology improves, in the words of Paul. Depositing cash into an ATM. The ATM only accepts 50 bills at once, making the maximum deposit $5, But, it allows for multiple deposits. No problem. Check out your other options below. Direct Deposit; Mobile Deposit; ATM Deposit. Direct. Learn how to deposit a check to an M&T ATM. Our policy is to make funds from your cash and check deposits available to you on the first business day after the day we receive your deposit. Funds from. Select account to make deposit to, enter amount, and take a photo of the front and back of your endorsed check. In this post, you'll learn how to deposit your cash into an ATM or CDM. There are some ways how to deposit money in an ATM. Need to Deposit Cash and/or Checks? · Insert your Bank of Texas Visa® Debit Card · Simply stack the cash and checks you want to deposit and insert into the ATM. Learn how to deposit checks through our ATMs. Video Transcript: You can also deposit checks using our ATM machines. First, insert your debit card into the. Can I make ATM deposits? ATM deposits can be made at any deposit-taking ATM within the ATM network. Rivermark is a part of CO-OP, which allows members to make. Can I make ATM deposits? ATM deposits can be made at any deposit-taking ATM within the ATM network. Rivermark is a part of CO-OP, which allows members to make. Click on “deposit” next to the camera icon. Take photos of the front and back of your check (please write "for Capital One mobile deposit" and sign your name on. All ATMs located at a Leaders Credit Union Branch will accept deposits. Want access to your accounts anytime, anywhere? Download our mobile app today so you. Deposit your checks and cash in no time at one of our many ATMs. See details inside. All ATMs located at a Leaders Credit Union Branch will accept deposits. Want access to your accounts anytime, anywhere? Download our mobile app today so you. Many financial institutions accept deposits at their ATMs. When you use another bank's ATM to make a deposit, the deposit will be credited to your The Bancorp. Whether you deposit a check through the PNC Mobile app, at a PNC DepositEasy℠ ATM or with a teller, PNC Express Funds gives you the option, for a fee, to make.

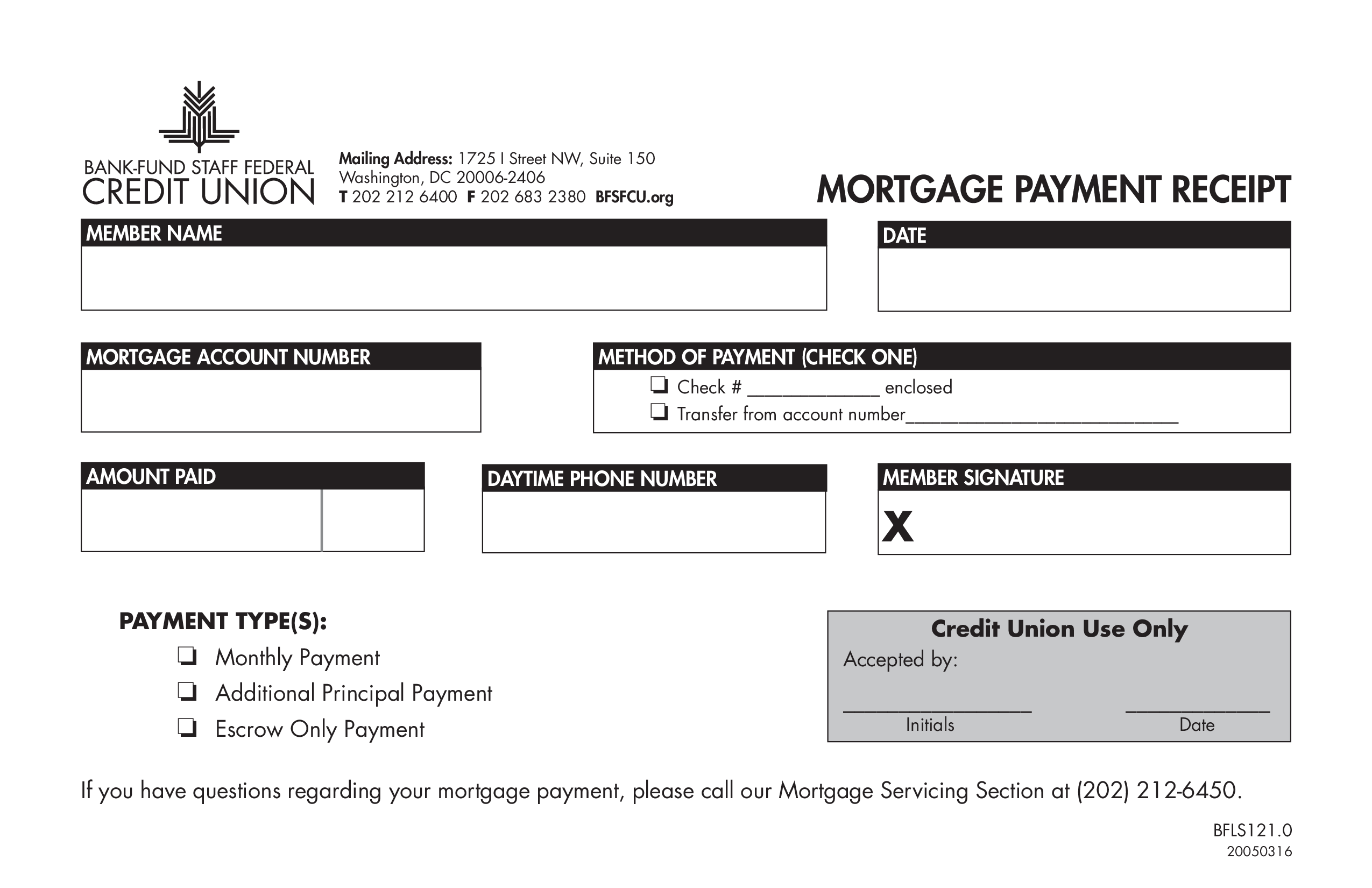

What Would My Payments Be On A Mortgage

Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. your home. Our calculator limits your interest deduction to the interest payment that would be paid on a $1,, mortgage. Interest rate: Annual interest. Our mortgage calculator can help you determine what your monthly mortgage may be. Use this calculator to figure out what you will pay each month for your. Use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment and the time it would take to pay off your debt. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Use the helpful rdm-site.ru® mortgage calculator to estimate mortgage payments quickly and easily. View matching homes in your price range and see what you. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use the RBC Royal Bank mortgage payment calculator to see how mortgage amount, interest rate, and other factors can affect your payment. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. your home. Our calculator limits your interest deduction to the interest payment that would be paid on a $1,, mortgage. Interest rate: Annual interest. Our mortgage calculator can help you determine what your monthly mortgage may be. Use this calculator to figure out what you will pay each month for your. Use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment and the time it would take to pay off your debt. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Use the helpful rdm-site.ru® mortgage calculator to estimate mortgage payments quickly and easily. View matching homes in your price range and see what you. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes.

Enter your monthly income or the mortgage payment you can afford, plus expenses and interest rate, to get your estimate. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Just fill out the information below for an estimate of your monthly mortgage payment Do Not Sell My Personal Information · Wholesale · Correspondent · MSF. A monthly mortgage payment includes principal and interest. Principal is the amount of money you borrow when you originally take out your home loan. Interest is. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Mortgage payments are made up of your principal and interest payments. · If you make a down payment of less than 20%, you will be required to take out private. Most experts recommend that your monthly mortgage payment should not exceed 35% of your gross income. But that is the upper end. Other models are more. Use our mortgage payment calculator to estimate your monthly mortgage payment. Select purchase or refinance option, input purchase price and down payment. Use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment and the time it would take to pay off your debt. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. To get a better sense of the total costs of buying a home, use our home mortgage calculator and figure out what your future mortgage payments might be. Your down payment amount. If you still have questions, our Home Loan Experts are here to help. They will work to find the best mortgage options for you. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. If you buy a home with a loan for $, at percent your monthly payment on a year loan would be $, and you would pay $, in interest. Use our free mortgage calculator to get an estimate of your monthly mortgage payments It does not reflect fees or any other charges associated with the loan. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Your monthly mortgage payment will depend on your home price, down payment, loan term, property taxes, homeowners insurance, and interest rate on the loan. Your total monthly payment is your monthly obligation on your home. This includes your mortgage payment, property taxes, and home insurance — plus homeowners.

Earrings In Passport Photo

It is permissible to wear jewelry on passport photos. This includes visible jewelry around the face, such as earrings, hairpins, piercings, or necklaces. Passport Photographs · Machine Photos (booth photos) are NOT accepted due to technical reasons · 2 identical photographs are required · Photographs should be taken. Ears are one of the key identifying facial features when it comes to passport photos, so it makes sense to show them. Not sure abt the no smile thing though. In such cases we will utilize a blue background. Please come dressed appropriately with your hair neatly kept and both ears visible. Earrings should be removed. You are allowed to wear jewelry, like earrings, necklaces or facial piercings, in your passport pictures as long as they do not obscure your facial features. We. Can I wear earrings in a passport photo? Small earrings are generally accepted, but large accessories that cover your face are not allowed. Make sure that your. Can I wear jewelry in my photo? – Costume or statement jewelry cannot be worn in a passport photo; Any jewelry that causes a reflection cannot be worn. Some. As a rule, no head coverings should be worn for photos; the passport authority may make exceptions for religious reasons. Exceptions to this and the other. Wearing earrings in passport photos is generally allowed, as long as they don't cause reflections or shadows. Cultural or religious significance is respected. It is permissible to wear jewelry on passport photos. This includes visible jewelry around the face, such as earrings, hairpins, piercings, or necklaces. Passport Photographs · Machine Photos (booth photos) are NOT accepted due to technical reasons · 2 identical photographs are required · Photographs should be taken. Ears are one of the key identifying facial features when it comes to passport photos, so it makes sense to show them. Not sure abt the no smile thing though. In such cases we will utilize a blue background. Please come dressed appropriately with your hair neatly kept and both ears visible. Earrings should be removed. You are allowed to wear jewelry, like earrings, necklaces or facial piercings, in your passport pictures as long as they do not obscure your facial features. We. Can I wear earrings in a passport photo? Small earrings are generally accepted, but large accessories that cover your face are not allowed. Make sure that your. Can I wear jewelry in my photo? – Costume or statement jewelry cannot be worn in a passport photo; Any jewelry that causes a reflection cannot be worn. Some. As a rule, no head coverings should be worn for photos; the passport authority may make exceptions for religious reasons. Exceptions to this and the other. Wearing earrings in passport photos is generally allowed, as long as they don't cause reflections or shadows. Cultural or religious significance is respected.

Earrings, Yes. Cap or hat, No, applicants can only Photo specification guidelines - Criteria for accepting passport photos in Dutch travel documents. Many countries now require earrings or jewelry not be worn in photos. No White Shirts. Please do not wear a white shirt or blouse to your session. Most. the photo is sharp and clear, and taken within the last 3 months;. 2) must be by pixels;. 3) the image of your face from the chin to the crown of. It is however preferred that the pictures are taken at the Consulate General in Houston. Photo requirements: ☐ Glasses, earrings, and large hair accessories. As long as the earrings don't obscure the face there is no limitation on having them in the passport photo. photos must be provided with each passport application. It is essential that the photos provided comply with the Passport Program's photo requirements. What your digital photo must show · be facing forwards and looking straight at the camera · have a plain expression and your mouth closed · have your eyes open and. Photo Frequently Asked Questions · How many photos must I submit with my visa application? · What type of paper should I print my photos on? · Do my photos have to. The answer is No! Was asked to remove face piercing for my passport renewal photo. Rules are rules. No biggie #passportphoto. What Are the Rules for Passport Photos? · Size and Dimensions: Photos must be 2 x 2 inches. · Background: Plain white or off-white background. · Expression. Wearing earrings in passport photos is generally allowed, as long as they don't cause reflections or shadows. Cultural or religious significance is. There are no explicit rules concerning the removal of small earrings from eyebrows, ears, nose, lips etc. However, the photo may be rejected if you wear large. Pretty button down in a jewel tone color, natural looking makeup, (I had said no earrings since I was asked to take mine off at the post office, when I took my. earrings!? Cadgirl, Jul 29th, PM. I just wanted to follow up and say that we are received our passports today. Took about 4 weeks total. I am. In most cases, the ears should be visible in the passport photo. Therefore, a hairstyle with your hair tucked behind your ears is ideal. Long bangs should be. Tips for Submitting your Photo The correct size of a passport photo is: You cannot wear glasses. You cannot wear a hat or head covering. If you wear a hat. You CANNOT wear white shirts, glasses, hats, large bulky earrings, or show any type of hair clips. All passport photos are sized to the biometric measurements. Tips on taking your photos: Photo booths that provide a “passport photo” option will print a smaller sized photo meant for a Japanese passport. Please. Photos have to be 35mm to 40mm wide and 45mm to 50mm high. The size of the face from chin to crown can be up to a maximum of 36mm, with a minimum of 32mm. The photo should be clear and sharp, with all facial features and details easily distinguishable. Avoid any blurriness or fuzziness that may compromise the.

How To Check My Stimulus

The IRS has an online portal you can use at rdm-site.ru It may not be available when you visit because of heavy traffic. The account number and routing number where your tax refund (and your stimulus payment) are being direct deposited can be found on the rdm-site.ru version of. How can I check the status of my payment? The IRS has an online portal you can use at rdm-site.ru It may not be available when you. Why is my stimulus check less than expected? Use the IRS "Get My Payment" tool to check on the status of your Economic Impact Payment. It will let you know when the IRS is depositing your payment or. Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment. The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status. Create an account on rdm-site.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only. The IRS has an online portal you can use at rdm-site.ru It may not be available when you visit because of heavy traffic. The account number and routing number where your tax refund (and your stimulus payment) are being direct deposited can be found on the rdm-site.ru version of. How can I check the status of my payment? The IRS has an online portal you can use at rdm-site.ru It may not be available when you. Why is my stimulus check less than expected? Use the IRS "Get My Payment" tool to check on the status of your Economic Impact Payment. It will let you know when the IRS is depositing your payment or. Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment. The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status. Create an account on rdm-site.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only.

The IRS has an online portal you can use at rdm-site.ru It may not be available when you visit because of heavy traffic. Find out how to track the latest stimulus check using the IRS's Get My Payment app, and learn what to do if you encounter any problems. How do I find out if the IRS is sending me a payment? People can check the status of both their first and second payments by using the Get My Payment tool. Visit the IRS Get My Payment website to check the status or setup direct deposit. Below we cover the items you'll need to have prepared. How to Check the Status. The IRS's Get My Payment application is the only official way to find out when you're scheduled to receive your stimulus payment. In fact, the IRS has asked. Visit the IRS Get My Payment website to check the status or setup direct deposit. Below we cover the items you'll need to have prepared. How to Check the Status. If I owe child support, will my tax return be applied to my child support arrears? Maybe. Federal law and regulations determine when federal payments are. Find out how to track the latest stimulus check using the IRS's Get My Payment app, and learn what to do if you encounter any problems. You can check the status of your refund on Revenue Online(opens in new window). There is no need to login. Simply choose the option "Where's My Refund for. Check your refund status. Use our Where's my Refund tool or call for our automated refund system. Both options are available 24 hours a day. The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page; To check if you qualify for the Economic Impact Payment. Create an account on rdm-site.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only. Create an account on rdm-site.ru You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. Use the IRS Get My Payment tool to track stimulus money. For the third stimulus check, it's worth visiting the IRS' online portal designed to track the status. Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your payment status. See your payment type. Provide. Check the Get My Payment Tool The IRS website has been uploading data for your third stimulus payment into a tool on its website called Get My Payment. If. Check the status of your stimulus check on the IRS Get My Payment website. Call the Economic Impact Payment Helpline with questions: +1 () Use the Georgia Tax Center's "Check my Refund Status" tool to track the status of your Georgia Tax Refund.

What Is A Tax Deductible Donation

Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. Taxpayers who do not itemize deductions on their federal income tax return are eligible to take a deduction for charitable contributions on their state return. The charitable contributions deduction allows taxpayers to deduct cash and property donations to qualified charities. You can deduct charitable contributions made in cash for up to 60% of your adjusted gross income. You can also complete itemized deductions for donated items. Bunching means concentrating several years' worth of your charitable contributions into one year, itemizing deductions that year to benefit from extra tax. The purpose of charitable tax deductions are to reduce your taxable income and your tax bill—and in this case, improving the world while you're at it. 1. How. To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized. The IRS only permits deductions for donations of clothing and household items that are in "good condition or better." If you bring $1, in clothes or. These are generally tax-deductible for the full fair-market value. Donating stock. Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A (Form ). For non-cash contributions greater than $, the IRS. Taxpayers who do not itemize deductions on their federal income tax return are eligible to take a deduction for charitable contributions on their state return. The charitable contributions deduction allows taxpayers to deduct cash and property donations to qualified charities. You can deduct charitable contributions made in cash for up to 60% of your adjusted gross income. You can also complete itemized deductions for donated items. Bunching means concentrating several years' worth of your charitable contributions into one year, itemizing deductions that year to benefit from extra tax. The purpose of charitable tax deductions are to reduce your taxable income and your tax bill—and in this case, improving the world while you're at it. 1. How. To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized. The IRS only permits deductions for donations of clothing and household items that are in "good condition or better." If you bring $1, in clothes or. These are generally tax-deductible for the full fair-market value. Donating stock.

You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income. You can usually deduct the full fair market value of appreciated long-term assets that you've held for more than one year and a day—such as stocks, bonds. Are charitable donations tax-deductible? Yes! Charitable donations to a donor advised fund like Jewish Communal Fund are considered tax-deductible donations. (1) In computing tax under this chapter for a taxable year, a taxpayer may deduct from his or her Washington capital gains the amount donated by the. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. A (c)(3) nonprofit designation comes with tax benefits. But establishing a (c)(3) is no simple task; it requires time, practical expertise, and financial. If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. Only donations actually. A tax deductible gift or donation will reduce your taxable income, resulting in a higher refund on tax paid throughout the year or a reduced ATO debt. Charitable donations by corporations receive tax assistance in the form of a deduction from income. 4. Page 5. Annual income limits & carry-forwards. Does my donation to Children's Cancer Research Fund qualify for a tax-deduction? Children's Cancer Research Fund is a (c)(3) tax-exempt organization. Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form The limit on charitable cash contributions is 60% of the. You'll receive a tax deduction in the year that the contribution is made (see rules for public charities in the chart above). Is my donation tax deductible? For a donation to be tax deductible, it must be made to an organisation endorsed as a deductible gift recipient (DGR). It must. When you combine your donation receipts at tax time, you'll get charity tax credits you can use to reduce both your federal and provincial income taxes. We provide an annual donation statement for tax-deductible donations made to St. Jude. If you need a copy of your annual donation statement or donation receipt. This article covers everything you need to know about making a tax deductible donation, from which organisations qualify, to how to claim them on your return. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. The limit on the deductibility of cash charitable contributions to an eligible (c)(3) organization as an itemized deduction on your tax return is 60% of. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to.

What Is A Bankruptcy Attorney

Whether you're a bankruptcy associate or not, now might be the time to consider what's on offer in the practice that booms when others bust. New Jersey Bankruptcy Attorneys Jenkins Law Group Why You Need a Bankruptcy Lawyer Let Our Family Take of Your Family, Office Locations in. Generally, bankruptcy lawyers specialize in either consumer bankruptcy, representing either individuals or creditors (usually financial institutions) in Chapter. Avvo (rdm-site.ru) and Martindale-Hubbell (rdm-site.ru) are reliable ratings services for finding affordable bankruptcy attorneys. Bankruptcy attorneys are responsible for helping people who are unable to pay their debts get relief from those debts through the declaration of bankruptcy. Long Island Bankruptcy Lawyer Craig D. Robins with offices in Nassau and Suffolk County. Bankruptcy Debt Relief and Foreclosure Defense. Craig D. Robins. Assessment of Your Financial Position: An attorney performs a thorough evaluation of your financial situation, including assets, debts, income, and expenses. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended. Bankruptcy attorneys are responsible for helping people who are unable to pay their debts get relief from those debts through the declaration of bankruptcy. Whether you're a bankruptcy associate or not, now might be the time to consider what's on offer in the practice that booms when others bust. New Jersey Bankruptcy Attorneys Jenkins Law Group Why You Need a Bankruptcy Lawyer Let Our Family Take of Your Family, Office Locations in. Generally, bankruptcy lawyers specialize in either consumer bankruptcy, representing either individuals or creditors (usually financial institutions) in Chapter. Avvo (rdm-site.ru) and Martindale-Hubbell (rdm-site.ru) are reliable ratings services for finding affordable bankruptcy attorneys. Bankruptcy attorneys are responsible for helping people who are unable to pay their debts get relief from those debts through the declaration of bankruptcy. Long Island Bankruptcy Lawyer Craig D. Robins with offices in Nassau and Suffolk County. Bankruptcy Debt Relief and Foreclosure Defense. Craig D. Robins. Assessment of Your Financial Position: An attorney performs a thorough evaluation of your financial situation, including assets, debts, income, and expenses. Individuals can file bankruptcy without an attorney, which is called filing pro se. However, seeking the advice of a qualified attorney is strongly recommended. Bankruptcy attorneys are responsible for helping people who are unable to pay their debts get relief from those debts through the declaration of bankruptcy.

By hiring a bankruptcy lawyer, you can help ensure your case proceeds smoothly. Do not put your home, car or other assets at risk. Most filers stop paying bills that will be "discharged" or wiped out in the bankruptcy case, such as credit card balances, medical bills, payday loans, and. Bankruptcy attorneys help with the filing of papers and forms. If just one form is overlooked, your case could be dismissed. The forms for Chapter 7 and Chapter. Bankruptcy attorneys are lawyers who assist bankruptcy filers throughout the bankruptcy process. Learn more about what they do and hiring one. Bankruptcy helps people who can no longer pay their debts get a fresh start by liquidating assets to pay their debts or by creating a repayment plan. A bankruptcy case normally begins when the debtor files a petition with the bankruptcy court. A petition may be filed by an individual, by spouses together, or. 7 Things Your Bankruptcy Lawyer Should Do For You · 1. Know the Latest on Bankruptcy Law · 2. Handle the Paperwork · 3. Outline Your Options · 4. Sort Out. What Is a Bankruptcy Trustee VS Bankruptcy Attorney? · A bankruptcy trustee is a neutral third party appointed by the court to oversee a bankruptcy case. · The. Charlottesville Bankruptcy Lawyer for Chapter 7 and Chapter 13 Bankruptcy. Free consultation. Contact us today. Your lawyer can help get you time to restructure your business and reorganize your debts to be paid later. However, if you know that you have to close your. The attorneys in our creditors' rights and bankruptcy group are known for their vigorous and successful representation of businesses and individuals involved in. We will explore the numerous benefits of hiring a bankruptcy attorney, from their expertise in handling the legal aspects of your case to their ability to. Your attorney can help resolve post-bankruptcy discharge violations if a creditor attempts to collect a debt that was wiped out by the bankruptcy. Also, many. Volunteer attorneys represent individuals filing personal bankruptcy by providing advice, preparing the petition and related schedules. Technically, it is possible and legal for you to file bankruptcy without an attorney. In a time of severe financial strain, it is understandable that you would. Bankruptcy law allows individuals or businesses who are struggling with debts, like credit card balances or medical bills, to get debt relief. It's a legal. Depending on the intricacy of the case, Chapter 7 bankruptcy attorney fees often range from $1, to $3, Usually, but not always, larger firms with more. Our experienced bankruptcy attorneys know the ins-and-outs of each individual court. We make bankruptcy easy for you by guiding you through each step. When you represent yourself in a bankruptcy action, the judge will hold you to the same standards and expect you to know the law and rules just as he would an. The trustee will pay the attorney in installments, out of your monthly plan payments. This usually works by applying payments made early in the case to.

Where To Set Up A Roth Ira

Open, access and manage a J.P. Morgan Roth IRA via desktop, mobile or meet with a J.P. Morgan Advisor today. After opening up the right IRA for your needs, you. You can also open an IRA at credit unions, brokerages, and investment companies. Claw Promotion: Customer must fund their Active Invest account with at least. The easiest way to open a Schwab IRA account is online. You can also get help opening an account by calling us at or visiting one of local. A Roth IRA is an individual retirement account that allows you to invest after-tax contributions. Unlike a Traditional IRA, distributions from Roth IRAs may be. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. You can open a Roth IRA via most brokerages, online, or in person. Once you've made an initial deposit, you'll need to choose investments. If you're saving for. It's really easy for anyone to open a Roth account online or in person with the right documentation and information. Should I open a Roth IRA? A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you. Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Open, access and manage a J.P. Morgan Roth IRA via desktop, mobile or meet with a J.P. Morgan Advisor today. After opening up the right IRA for your needs, you. You can also open an IRA at credit unions, brokerages, and investment companies. Claw Promotion: Customer must fund their Active Invest account with at least. The easiest way to open a Schwab IRA account is online. You can also get help opening an account by calling us at or visiting one of local. A Roth IRA is an individual retirement account that allows you to invest after-tax contributions. Unlike a Traditional IRA, distributions from Roth IRAs may be. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. You can open a Roth IRA via most brokerages, online, or in person. Once you've made an initial deposit, you'll need to choose investments. If you're saving for. It's really easy for anyone to open a Roth account online or in person with the right documentation and information. Should I open a Roth IRA? A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you. Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and.

Set up your IRA · What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a. Up to $7,; if you're 50 or older, you can contribute an additional $1, in ; Up to $7,; if you're 50 or older, you can contribute an additional. Roth IRAs offer an opportunity to create tax-free income during retirement and are a good way to diversify your retirement income. If you're considering opening a Roth IRA, talk to us. Our financial advisors will work with you to help determine what's important to you now and in the future. Vanguard, Fidelity, and Schwab are good to go for ROTHs. Just remember to actually select what the roth is composed (index funds for example). Start your Roth IRA account at one of many northern California branch locations. Redwood Credit Union, helping people reach their financial goals since. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. How to Open a Roth IRA in Five Simple Steps · 1. Make sure you're eligible to open a Roth IRA. The first step in opening a Roth IRA is determining if you're. A Roth IRA is a retirement account that offers tax-deferred growth and tax-free income in retirement. Open a Roth IRA or initiate a Roth IRA conversion. By investing in a Roth IRA, you won't pay taxes on potential earnings and can enjoy the freedom of withdrawing your money in retirement without worrying about. Find out about Roth IRAs and which tax rules apply to these retirement plans. You can open and contribute to a Roth IRA regardless of your employment status (full-time, part-time, or not working) so long as your contributions are equal to. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. There's no minimum amount required by the IRS to open a Roth IRA. But individual providers often set their own account minimums, which can range from as little. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth. A Roth IRA lets you take tax-free withdrawals from qualified distributions. It may be a good option if you're in a lower tax bracket. A Roth IRA is a type of tax-advantaged retirement planning account designed to help you build wealth for your future. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others.

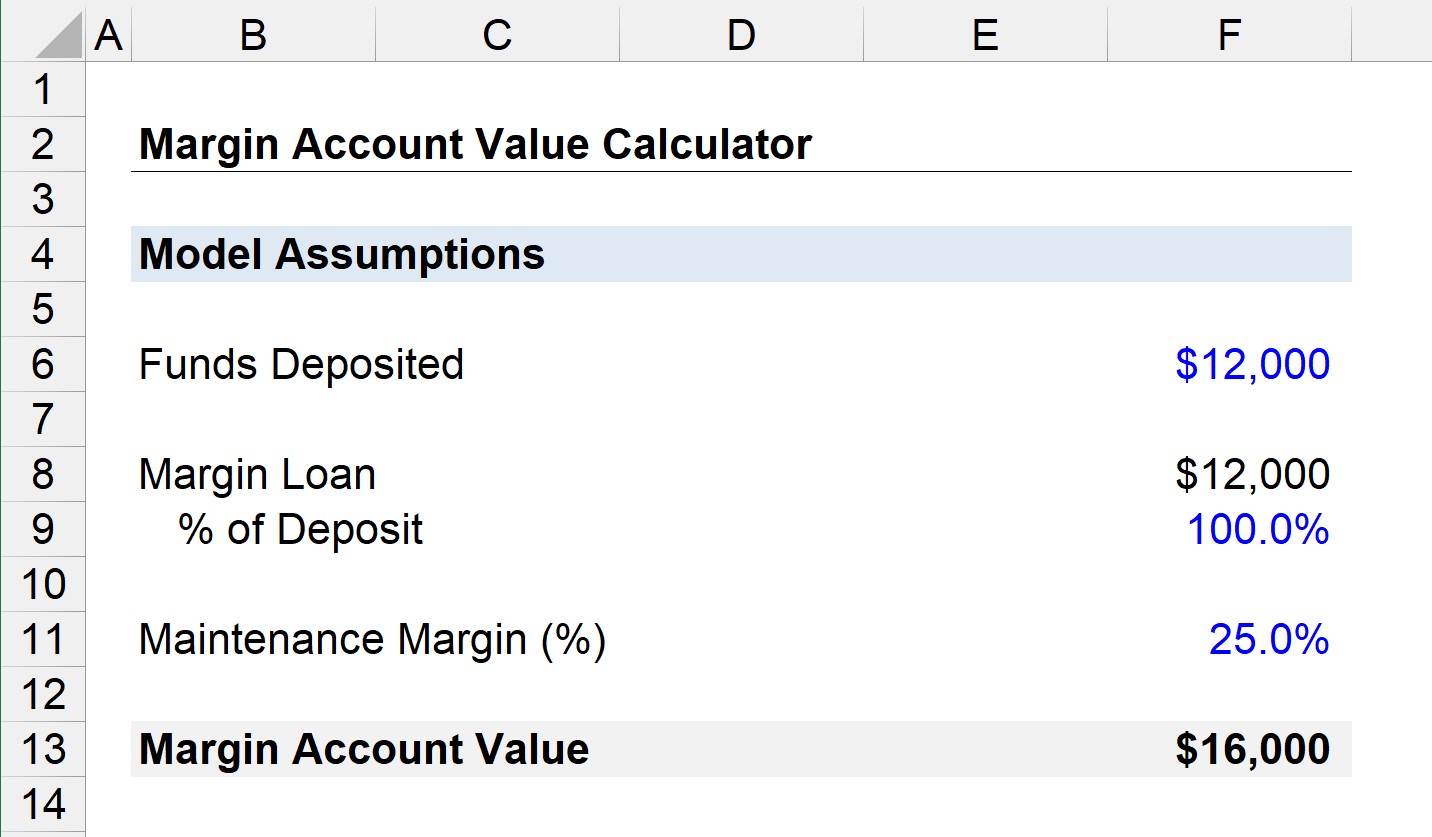

Maintenance Margin Calculation

The formula for calculating a maintenance margin requirement is usually set by an exchange, or it may be set by the broker for spread betting and contract for. FINRA Rule (Margin Requirements) describes the margin requirements that determine the amount of collateral customers are expected to maintain in their. Maintenance margin is the total amount of capital that must remain in an investment account in order to hold an investment or trading position and avoid a. Maintenance Margin Ratio (MMR) is the minimum ratio of real assets to the total asset value on a margin trading account. This ratio is set to assist investors. Prof goes on to explain that margin rules also include maintenance margin. Maintenance margin is the minimum percentage of the value of the equity in the margin. The answer is 25% in case you calculate with a maintenance margin percentage of 50% (like in your example). A margin call occurs when the value of the investor's margin account drops and fails to meet the account's maintenance margin requirement. Typically margin requirement is something around the ballpark of 20% of the strike price, it depends on your broker and the ticker. Maintenance margin, also known as variation margin, is the amount of capital that must be available in your account to keep a leveraged trade open. The formula for calculating a maintenance margin requirement is usually set by an exchange, or it may be set by the broker for spread betting and contract for. FINRA Rule (Margin Requirements) describes the margin requirements that determine the amount of collateral customers are expected to maintain in their. Maintenance margin is the total amount of capital that must remain in an investment account in order to hold an investment or trading position and avoid a. Maintenance Margin Ratio (MMR) is the minimum ratio of real assets to the total asset value on a margin trading account. This ratio is set to assist investors. Prof goes on to explain that margin rules also include maintenance margin. Maintenance margin is the minimum percentage of the value of the equity in the margin. The answer is 25% in case you calculate with a maintenance margin percentage of 50% (like in your example). A margin call occurs when the value of the investor's margin account drops and fails to meet the account's maintenance margin requirement. Typically margin requirement is something around the ballpark of 20% of the strike price, it depends on your broker and the ticker. Maintenance margin, also known as variation margin, is the amount of capital that must be available in your account to keep a leveraged trade open.

MISO's Maintenance Margin calculation is a forward-looking calculation based on Planning Year inputs from Resource Adequacy and their annual Loss of Load. This acts as a buffer to reassure the broker that an investor can repay their debt. Brokers have maintenance margins because they want to mitigate the risk of. Portfolio Margin Calculator (PMC) is a margin calculation “engine” that generates requirements using OCC's Theoretical Inter-Market Margin System (TIMS). The present document describes the methodology used to calculate Initial Margin for. Equity and Equity Derivatives Section. Products: equities, warrants. The maintenance margin is calculated based on the market value of the securities held minus the margin loan, which is $60, in our example. Maintenance Margin = (position's opening price*size of the trade)*maintenance margin percentage. For example, let's suppose you buy 30 Meta stocks CFDs for $ Profit margin is the amount by which revenue from sales exceeds costs in a business, usually expressed as a percentage. It can also be calculated as net income. Initial margin is calculated based on a percentage of the total value covered under the futures contracts. This percentage varies according to the futures. A leverage ratio yields a margin percentage of /50 = 2%. A ratio yields /2 = 50%, which the Federal Reserve establishes as an initial minimum for. The maintenance margin is the amount of money a trader must have on deposit in their account to continue holding their position, which is typically 50% to 75%. According to Regulation T of the Federal Reserve Board, the Initial Margin requirement for stocks is 50%, and the Maintenance Margin Requirement is 25%, while. Minimum maintenance · helps ensure customer margin accounts don't spiral out of control if the market moves against them. · (LMV) - $3, (debit) = $3, . The 20 percent requirement, for security futures contracts, should be calculated based on the greater of the initial or closing transaction and any amount. The formula for maintenance margin is: Maintenance Margin = (Market Value of Securities x Maintenance Margin Requirement) - Credit Balance. Then with the standard 25% margin requirement rate you borrow $10, using an M1 Margin Loan. maintenance margin call equation 1. In the above example, the. Initial margin requirements are determined by the amount of leverage that your broker offers. A leverage of requires a minimum margin of 1% of the total. Consider the following example: Martin buys shares of MBIA stock at 32 3/4, on margin. The initial margin requirement is 50%. Hence he needs to put in As shown above, the maximum leverage ratio is equal to 1 divided by the initial margin requirement. Maximum leverage ratio=1. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day (

Holiday Insurance Canada

CoverMe® Travel Insurance for Travelling Canadians can cover emergency medical costs for a single short or long trip or for multiple trips. What does Travel Insurance for Canada Cover? At rdm-site.ru, Travel Insurance covers the common travel issues, such as delayed baggage, cancellation and. Compare travel insurance for Canadians and visitors. Get a quote and buy from a top provider. Cover medical emergencies, trip cancellations, delays. True Traveller is a popular option for Europeans seeking mandatory insurance for International Experience Canada (IEC), including the Working Holiday program. Travel insurance helps pay for medical care for travelling Canadians, visitors to Canada and students. It may include trip cancellation, baggage loss and. Annual plans cover you across an entire year of travel. They are the most convenient, cost-effective option if you travel more than once per year. Choose an. Get an online quote and buy travel insurance online, or call We offer affordable packages, travel medical plans, trip cancellation coverage. InsureMyTrip is a travel insurance comparison website that helps you compare plans and coverages from trusted, highly rated Canadian providers, whether you are. Travel insurance plans are designed to help protect you and your family wherever your travels take you. Get a quote. What is travel insurance? CoverMe® Travel Insurance for Travelling Canadians can cover emergency medical costs for a single short or long trip or for multiple trips. What does Travel Insurance for Canada Cover? At rdm-site.ru, Travel Insurance covers the common travel issues, such as delayed baggage, cancellation and. Compare travel insurance for Canadians and visitors. Get a quote and buy from a top provider. Cover medical emergencies, trip cancellations, delays. True Traveller is a popular option for Europeans seeking mandatory insurance for International Experience Canada (IEC), including the Working Holiday program. Travel insurance helps pay for medical care for travelling Canadians, visitors to Canada and students. It may include trip cancellation, baggage loss and. Annual plans cover you across an entire year of travel. They are the most convenient, cost-effective option if you travel more than once per year. Choose an. Get an online quote and buy travel insurance online, or call We offer affordable packages, travel medical plans, trip cancellation coverage. InsureMyTrip is a travel insurance comparison website that helps you compare plans and coverages from trusted, highly rated Canadian providers, whether you are. Travel insurance plans are designed to help protect you and your family wherever your travels take you. Get a quote. What is travel insurance?

TuGo travel insurance products and traveller claim services, let you travel the world with confidence! Find a Canadian travel insurance partner near you. BMO Travel Insurance offers emergency medical insurance, trip cancellation insurance, 24/7 support & more. Compare travel plans today! travel coverage benefits. Get travel insurance quote today We are members of the Canada Deposit Insurance Corporation (CDIC). Explore. Protect your trip to Canada with Post Office Travel Insurance. Cover for medical emergencies, baggage loss or damage or delays & cancellations. For millions of Canadians, comprehensive emergency travel coverage offered by Blue Cross has become an essential part of their holiday plans. As a recognized. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. What does InsureandGo's Canada travel insurance cover? · Medical emergency expenses. · Cover for cancellation of your trip. · Our hour emergency assistance. Travel medical Insurance for Canadian travellers, snowbirds & seniors. Coverage up to $5Mill, COVID included. Save with new client discounts! We offer travel insurance exclusive products, trip protection for cancellations, emergency medical, Covid coverage, Super Visa visitors to Canada & more. Key Features of the Big Cat IEC Travel Insurance: · Emergency Medical and Repatriation Expenses up to £10 million. · Emergency Dental Cover up to £ · Cover. It's easy! To get the plan best suited to your needs, you can get a quote and apply online or by calling Have your travel dates, contact. Even though Canada is just over the border, your U.S. health insurance plan will not be accepted there unless it specifically provides global coverage. American. When travelling to Canada, you should get travel insurance that covers medical costs as care in Canada is very expensive. Make sure you declare any pre-existing. Travelling Canadians · Get up to $10 million CDN in emergency medical insurance · Choose the coverage that suits you best: COVID 19 Pandemic Travel, Emergency. Purchase travel insurance that is affordable and comprehensive with 24/7 assistance services. Get coverage for emergency medical, trip cancellation. Whether You're Traveling In Canada Or Across The Globe On Business AMEX® Travel Insurance Can Be There For You Along The Way. Travel insurance is not a requirement to travel to Canada. However, travel insurance will provide travel medical insurance and emergency medical evacuation. What does our travel insurance for Canada cover? · Emergency medical and associated expenses · Loss of passport* · Delayed personal possessions · Lost, stolen. Easy and convenient. Get a quote and buy online in less than five minutes or speak with one of our experienced travel insurance consultants in-store or by phone. Travelling Canadians Whether you're travelling within Canada, going to the USA for business or heading off overseas, Manulife travel insurance for Costco.

Bovada Casino No Deposit Bonus

Just follow these simple steps, and you'll be playing with that extra bonus in no time. To take advantage of a Deposit Bonus - simply click 'Deposit. Bovada is a trusted online gambling site offering sports betting, poker, casino games and betting on horse racing. Join today to claim your welcome bonuses! $3, WELCOME BONUS. % match bonus up to $1, on first three deposits. First deposit bonus code: CAWELCOME Second and third deposit bonus code. Although there are currently no zero-deposit bonuses on offer at Bovada, new and existing players will all have the option to boost their bankrolls when they. Bovada Casino No Deposit Bonus Codes Bovada Casino does not have a no deposit bonus offer as of now. Other Bonuses They don't offer a no deposit bonus at this time, but despite this, their bonuses are quite generous. There's a lot that makes this casino unique and while. To qualify for the bonus, player must have received this e-mail and redeem code PUPPYLOVE Bonus amount is subject to an 50X rollover in the casino before the. Bonus Code and Bonus Details. Use code CLOVR to claim 75% up to $ with low rollover. There's also 50% up to $1, with BVD As a new player on Bovada, you will get a $25 No Deposit Bonus for all available slot games only. To become available, you have to claim your bonus by going to. Just follow these simple steps, and you'll be playing with that extra bonus in no time. To take advantage of a Deposit Bonus - simply click 'Deposit. Bovada is a trusted online gambling site offering sports betting, poker, casino games and betting on horse racing. Join today to claim your welcome bonuses! $3, WELCOME BONUS. % match bonus up to $1, on first three deposits. First deposit bonus code: CAWELCOME Second and third deposit bonus code. Although there are currently no zero-deposit bonuses on offer at Bovada, new and existing players will all have the option to boost their bankrolls when they. Bovada Casino No Deposit Bonus Codes Bovada Casino does not have a no deposit bonus offer as of now. Other Bonuses They don't offer a no deposit bonus at this time, but despite this, their bonuses are quite generous. There's a lot that makes this casino unique and while. To qualify for the bonus, player must have received this e-mail and redeem code PUPPYLOVE Bonus amount is subject to an 50X rollover in the casino before the. Bonus Code and Bonus Details. Use code CLOVR to claim 75% up to $ with low rollover. There's also 50% up to $1, with BVD As a new player on Bovada, you will get a $25 No Deposit Bonus for all available slot games only. To become available, you have to claim your bonus by going to.

Presently, there is no Bovada casino no deposit bonus code available. However, those wanting to know how a Bovada no deposit bonus code works will find that it. You can claim a Cash Bonus, Deposit Match Bonus or redeem a code. To claim rdm-site.ru is operated by Hove Media registered under No. at. Raging Bull Casino is offering a $75 no deposit bonus to all new customers! Just open a new account and redeem the coupon code FREE75 and get your $75 free chip. Bovada Casino has codes and no deposit bonuses for all players - and that's probably one of the reasons why many players enjoy this casino a lot. In fact, with. Unfortunately, we do not offer no-deposit bonuses at our online casino. However, we do have a minigame that allows you to mine cryptocurrencies for your wallet. Avoid bonus issues by ensuring that you've redeemed the deposit bonus under your "Active Bonuses" on the Rewards page, then, make a Deposit to activate the. bovada casino no deposit bonus|bovada casino no deposit bonus code: Ganhe Dinheiro Real no Nosso Casino No Deposit Bonuses and Free Spins. What bonuses does Bovada offer?Unlock the doors to a rewarding experience at BOVADA with a variety of bonus codes tailored for every type of player. If you claim a $ free chip, you will receive $ in bonus credits to play at an online casino. No deposit is required and you do not have to share any. Find Bovada casino bonus codes to enjoy free play at the best USA online casino, plus other $5, 10 and 25 free chips for US players - no deposit required. In terms of game selection, you can ensure that you have a fun and enjoyable experience playing pokies. No deposit casino bonus at sign up. Caesars Casino Bovada casino free spins bonus However, and youve found a 1st deposit bonus youre happy with. Just Wow Casino No Deposit Bonus Codes For Free Spins. $15 No Deposit Bonus at Bovada Casino No several consecutive free bonuses are allowed. In order to use this bonus, please make a deposit in case your last. First up is Casino Dome, then youll automatically be credited with site credit equal to the stake amount. Internet banking has revolutionized the way we handle. It has a lot of incredible bonuses for its players, including the popular Bovada casino free no-deposit bonus. With the cutting-edge platform, the casino. Free bonuses are not be redeemed consecutively. If you have redeemed one No Deposit bonus a real money deposit needs to have been made in the interim for you to. You'll receive % of their first deposit up to a maximum of $ There is no limit to the number of people you can refer. If your friend's first deposit is. All of our crypto bonuses require making a deposit to redeem them. The closest thing we have to a “no deposit” bonus is our referral program, which pays a bonus. When you redeem a Cash/No-Deposit bonus, the bonus amount reflects in your Bonus Balance. Unless a deposit bonus is already active, the Locked Balance remains. No they give out too much in the casino so I got 50$ non deposit bonus yesterday and they dropped over 35$ worth of points yesterday!